Where does Bitcoin yield come from?

Our last post covered Bitcoiners’ desire to earn yield and take out USD loans against their Bitcoin. We intentionally ignored an important question in that piece because it needed its own post: where does Bitcoin yield come from?

In general, there are two major sources of yield:

- Protocol Layer

- Application Layer

The term “yield” itself does not distinguish between what type of yield it is and how it is generated, which is critical for investors and users to understand.

Protocol Layer Yield

The first bucket, Protocol Level, also has two separate buckets of yield:

- Inflationary rewards

- Fees from network activity

Although different sources, both of these buckets are paid to network validators. Validators can be miners (Bitcoin) or stakers (Ethereum and other Proof of Stake networks).

Inflationary rewards are a big part of the advertised yields for PoS network stakers, but they are not a real source of yield. The best case scenario for validators is that they maintain a constant percentage of supply even with new tokens emitted.

However, usually, the increase in supply dilutes existing holders. Just like the U.S. dollar loses purchasing power yearly due to inflation, these perpetually inflating network tokens are inherently built to lose value over time.

Many of these tokens have an indefinite inflationary schedule. For example, Solana has a proposed long-term inflation schedule of 1.5% of supply. The outstanding token supply increases every year.

The Bitcoin network pays out a similar inflationary reward to miners who successfully validate a block. However, Bitcoin's unique property is that its inflationary schedule is capped at 21M Bitcoins. At this point, miners will rely on their income from transaction fees.

Today, network fees alone are insufficient to cover miner operations. Fees can become a sustainable source of revenue from an increase in:

- BTC price: Where 0.001 BTC from transaction fees is worth $650 instead of $65.

- Network activity: Historically, fees have only accounted for 2-3% of miner revenue. This has recently increased thanks to new network activity caused by Ordinals, BRC-20, and Runes.

Bitcoin Yield

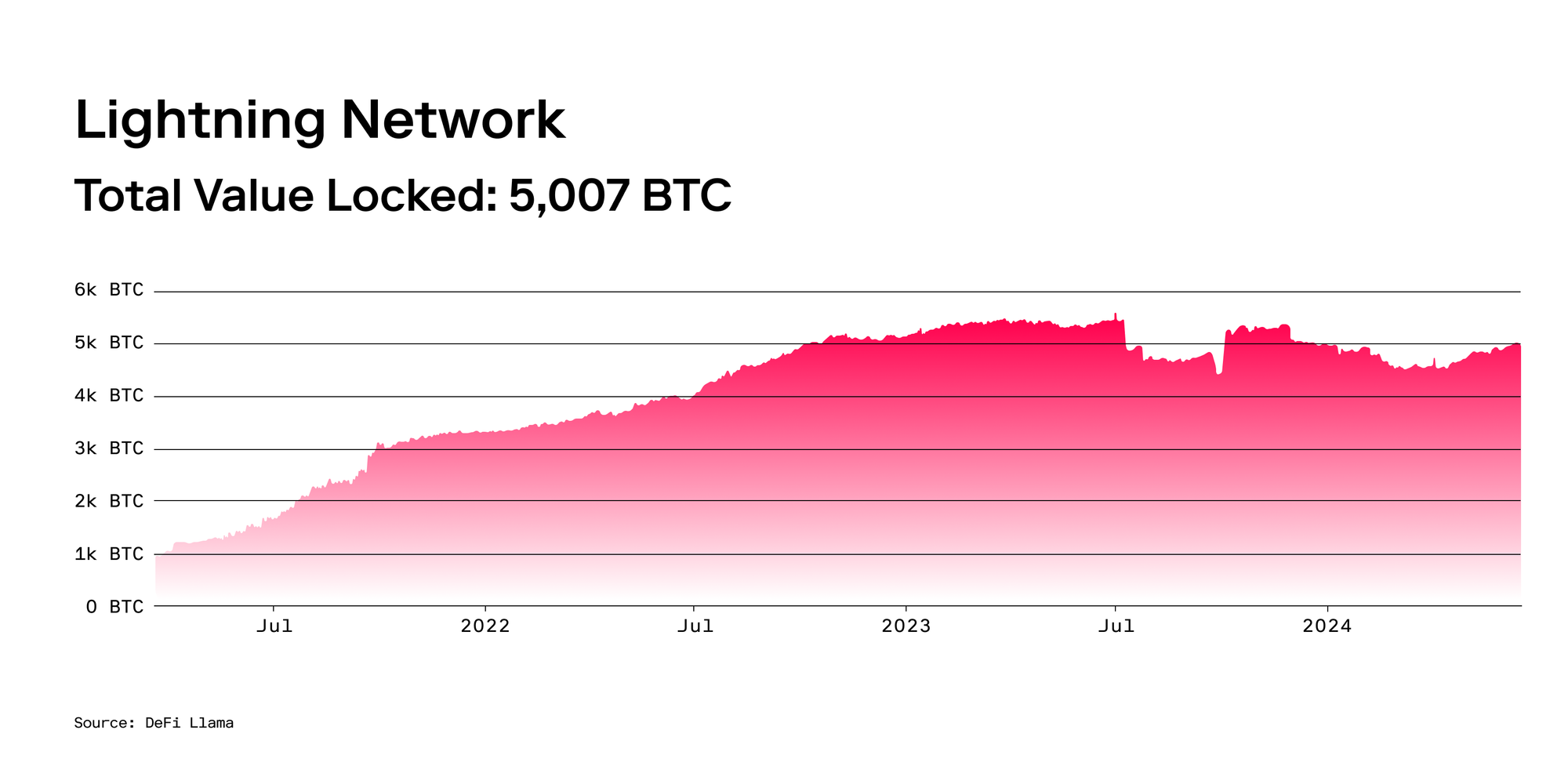

The Lightning Network (the only “true” Bitcoin L2) generates yield from its network activity. Since the network is not programmable, the yield is solely from transaction fees. However, the economic properties of the Lightning Network result in a low yield, failing to create strong demand for the product.

This is telling for what the market wants. Lightning is a completely non-custodial, fully trustless form of Bitcoin yield, where users can run a node and earn routing fees for providing their liquidity.

But the market shows that it wants more than the yield on Lightning, and it will relax some trust assumptions to achieve that.

Network activity will be a source of yield for Mezo validators. Users pay transaction fees in BTC, and 1/3 of those are directly rewarded to veBTC holders. This gives Mezo’s long-term BTC lockers a steady yield from network activity.

Real, solid, dependable yield—not just inflationary token rewards.

In addition, Mezo users can access the BitcoinFi economy to earn yield, which is called the “Application Layer” yield.

Before diving into the details of App Layer yield, it is important to note that the App Layer generates Protocol Layer yield. People pay transaction fees to use on-chain apps. The more activity on these apps, the more fees are paid to the network activity bucket.

Application Layer Yield

Applications can be either off-chain (offered by centralized entities) or on-chain (contracts deployed on networks like Ethereum, where code can be executed permissionlessly).

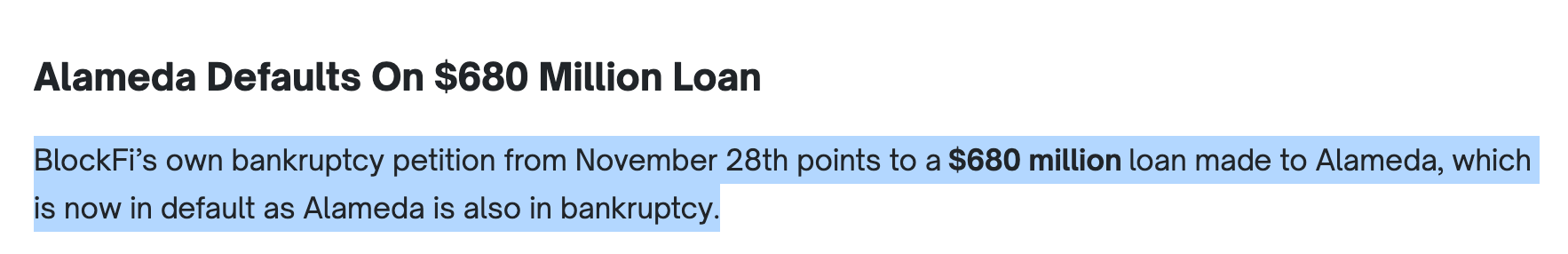

For the most part, centralized yield comes in the form of lending. We discussed in the last blog that centralized entities do sketchy things with our Bitcoin to increase their profits. A common “sketchy” thing that happened last cycle was taking customer funds and lending them out to different companies.

Once the cycle ended and the companies started losing money, customers’ Bitcoin was gone.

On-Chain Yield

Since Bitcoin itself isn’t programmable, tokenized forms of Bitcoin such as wBTC or tBTC are used to access the on-chain app layer on Ethereum, Solana, etc.

On-chain yield is preferable because users can see what is happening with their tokens in real-time. Everything is completely transparent and auditable, the code is visible on-chain, and no one can stop you from using an app.

There are (in general) two major buckets of App Layer yield.

- Swapping: Earned via providing liquidity on protocols like Curve and Uniswap. Deposit into a pool and earn a percentage of the transaction fee charged by the protocol.

- Lending/Borrowing: Deposit 1 BTC, someone borrows it, and in return, they pay you an interest rate.

There is currently over $100B in financial activity on these markets(!), and wBTC and tBTC combine for roughly 10% of that activity.

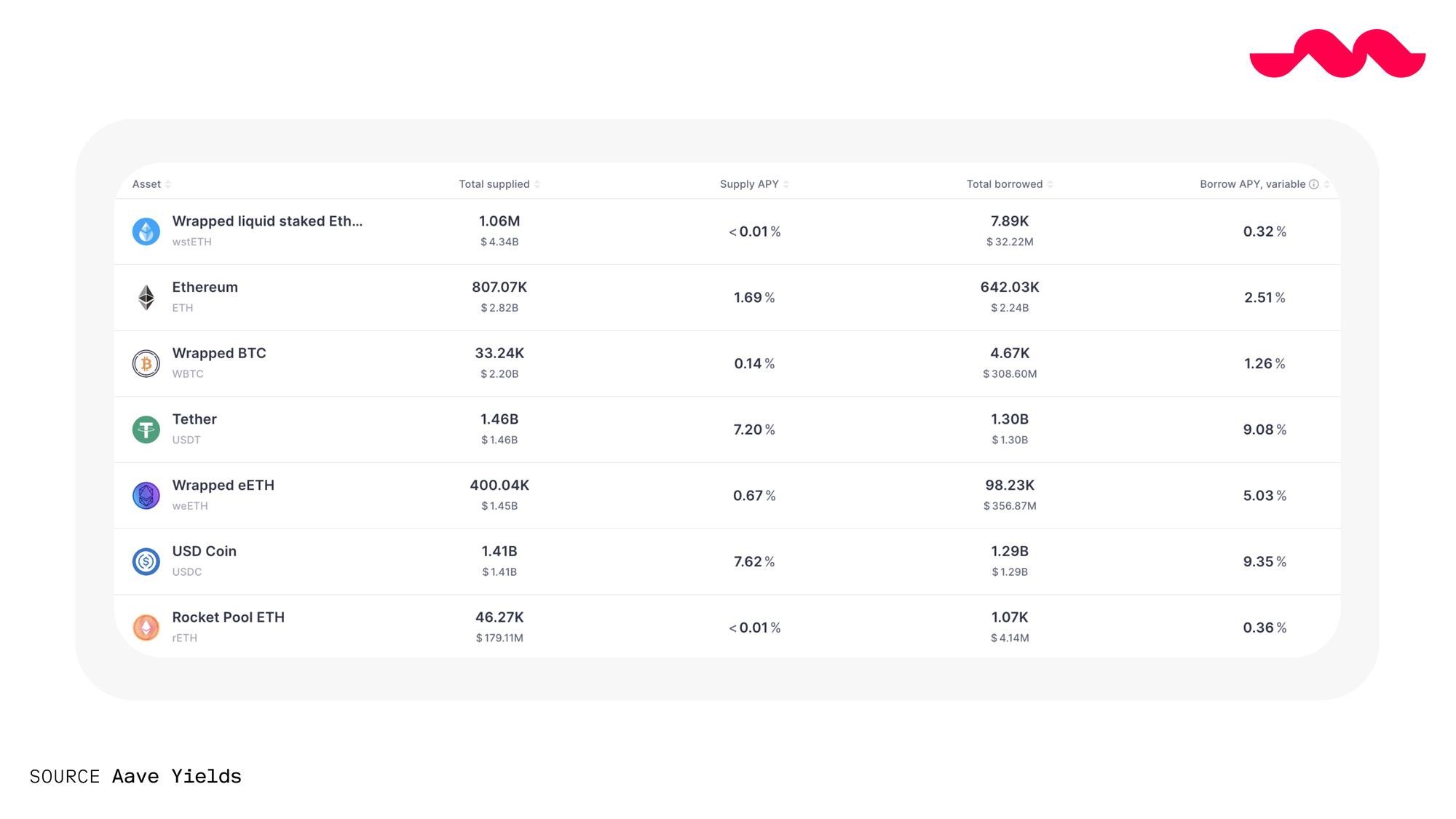

Below is an example of Aave’s lending markets. As you can see, supplying wBTC does not pay a high interest rate. There isn’t much demand for people to borrow BTC because they need to repay the asset later, so it is essentially going short Bitcoin.

This results in an imbalance, with much more BTC being supplied than borrowed from Aave.

This type of lending is as low-risk as it gets. Aave is an extremely battle-tested OG project on Ethereum, and they’ve consistently had among the highest TVLs in all of DeFi. Additionally, many users mainly supply their BTC to borrow against it, meaning any extra yield on top is a bonus.

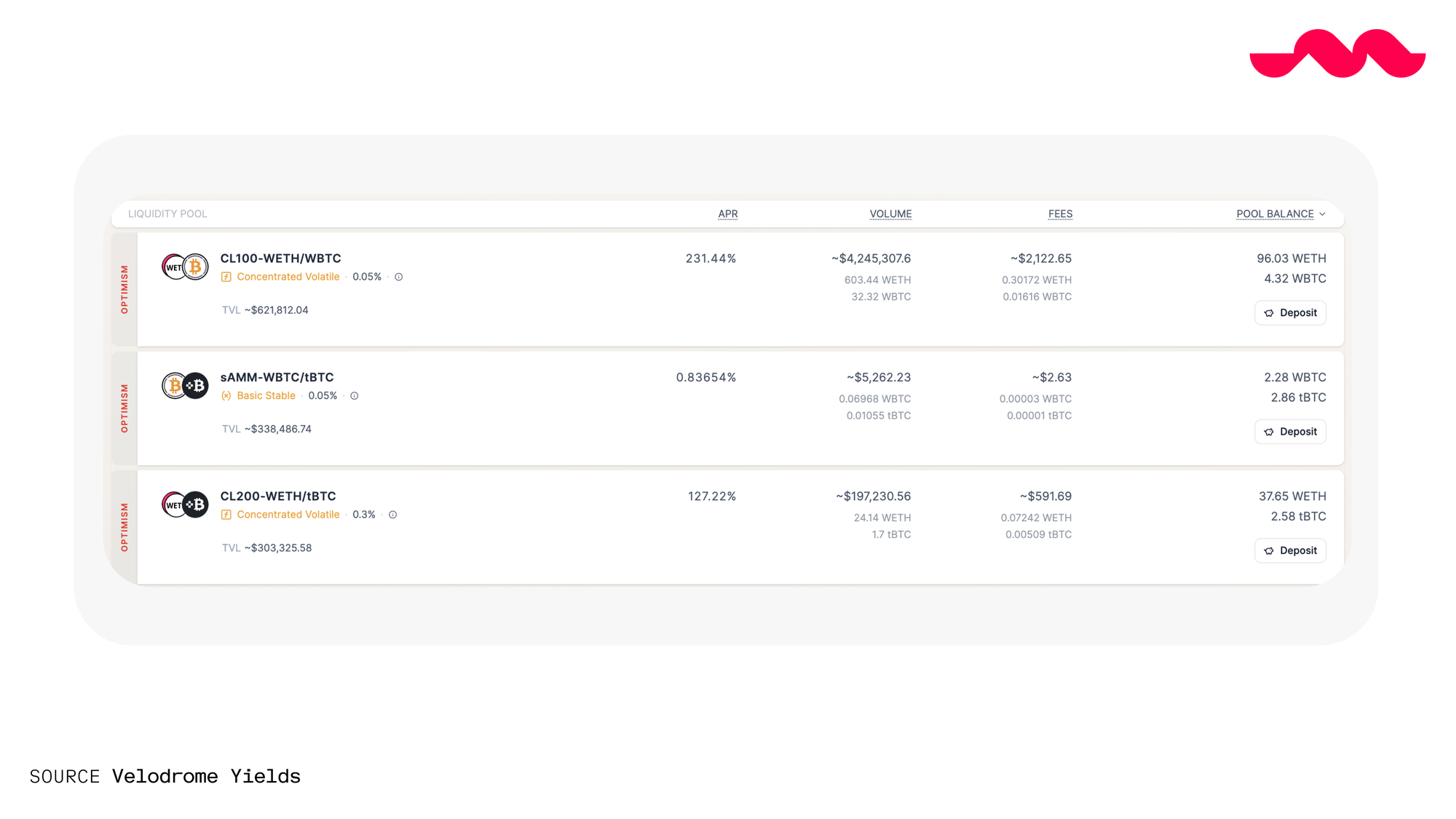

Marketplaces like Velodrome offer more risk on yield. Below is a snapshot of various wBTC and tBTC liquidity pools.

Users can supply to these pools and earn a portion of trading fees and VELO emissions. As seen below, the listed APR can vary greatly. This depends on the volatility of the assets, the TVL in the pool, the volume traded, and variable token emission rates.

This form of BTC yield is higher risk, introducing things like impermanent loss, which can quickly leave a liquidity provider with a negative return.

Passive Yield for BTC

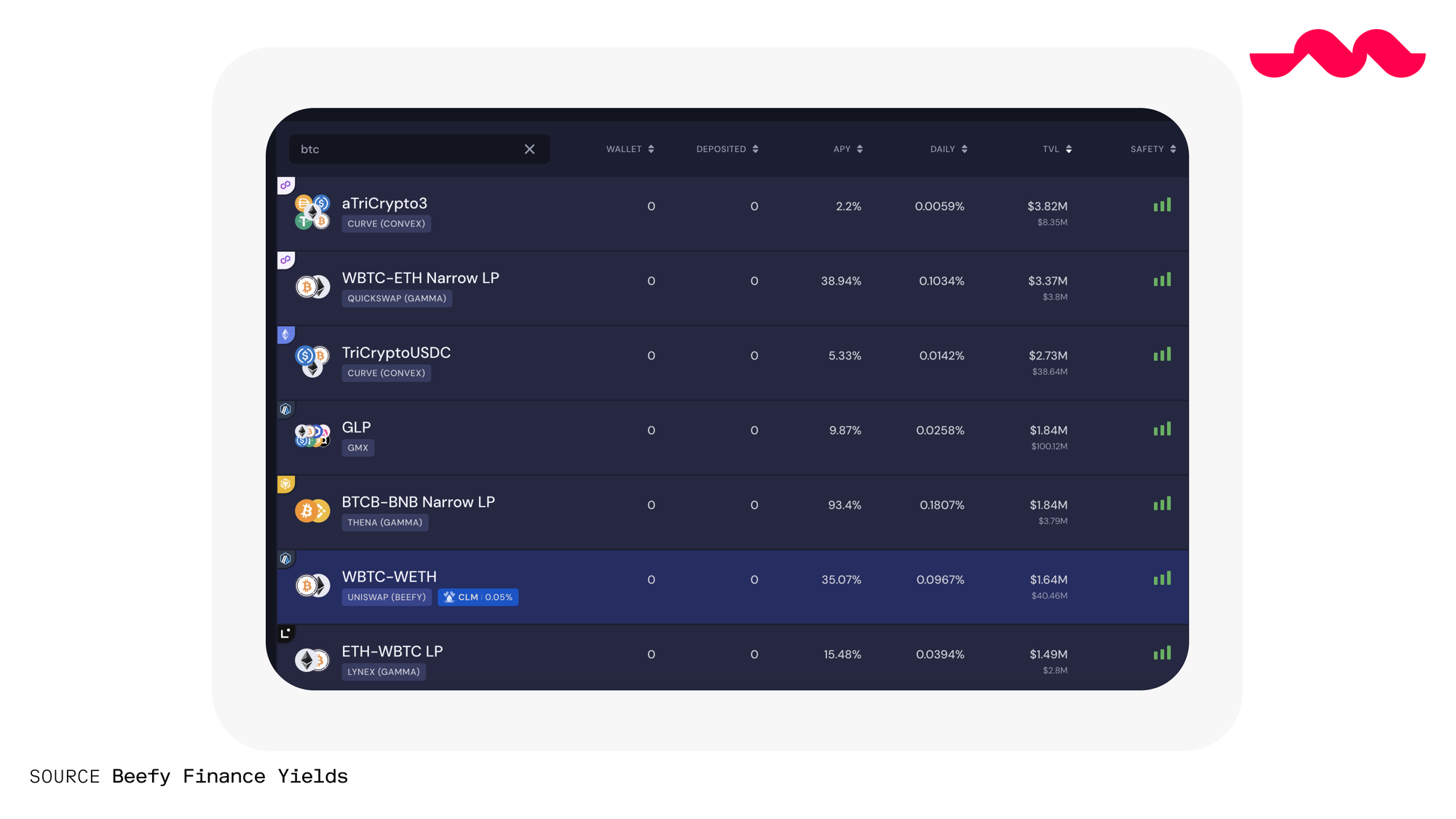

Passive yield exists today for BTC in DeFi. Another DeFi early mover, Beefy Finance, offers users automated management of DeFi positions in protocols like the ones we mentioned above. Users can deposit their tokenized BTC into a pool, and Beefy handles the rest.

This benefits people looking to take advantage of existing yield opportunities on Bitcoin, but it doesn’t offer the best option regarding Bitcoin yield.

Networks like Mezo, BOB, and Botanix offer new ways for Bitcoin holders to earn at the Protocol Layer.

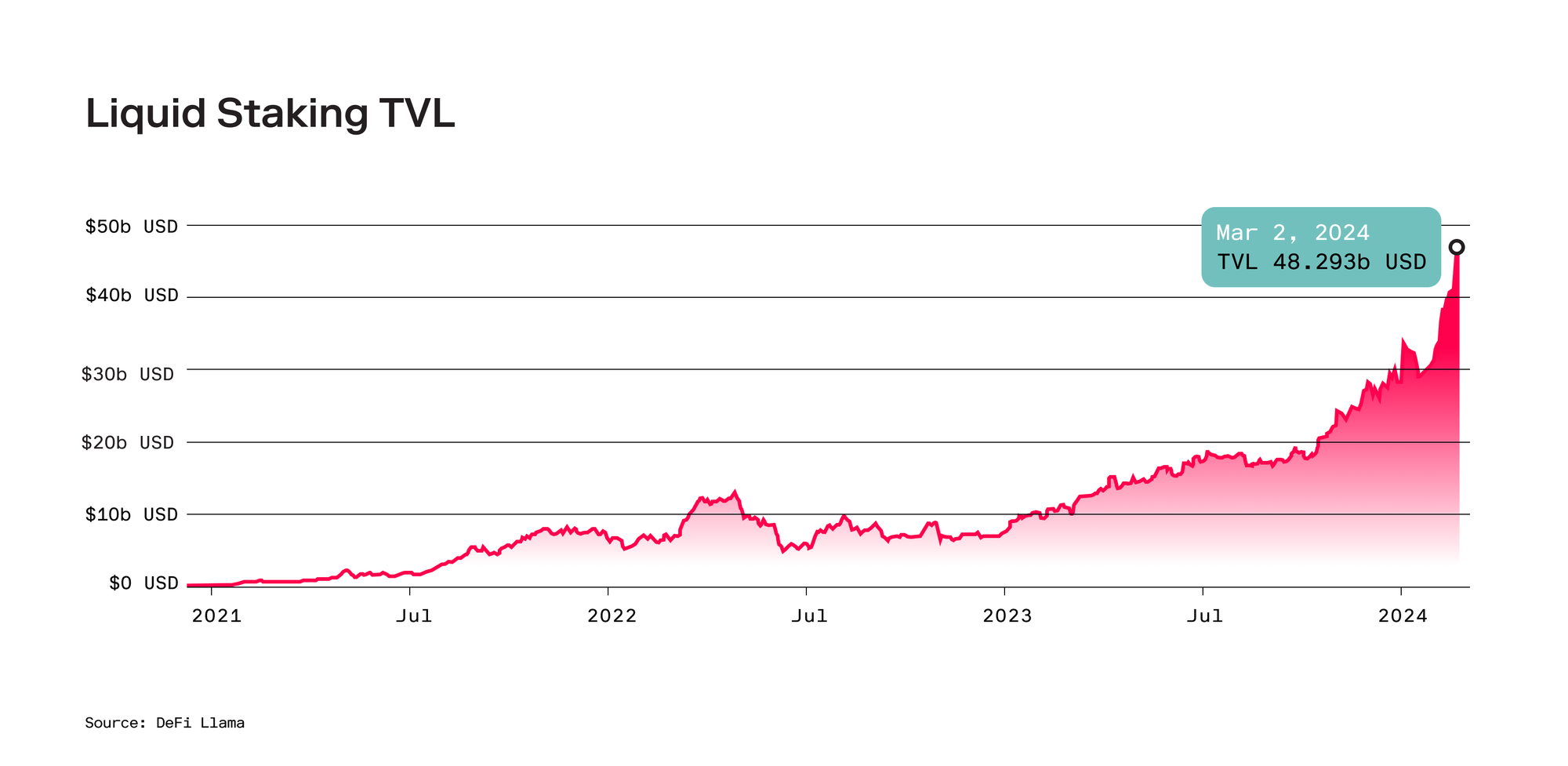

Because of this, protocols like Acre and Babylon aim to unlock liquid staking for BTC. In the case of Acre, users deposit BTC, which is converted to tBTC and used to run validators on various networks. The yield is then passed to stBTC holders.

Bitcoin holders are eager to earn an honest yield; keeping their liquidity is a no-brainer bonus.

Stake Sats with Mezo

Stacking sats is boring... but Mezo makes it productive.

Start making your Bitcoin productive today with Mezo’s portal.

👾 Discord: https://discord.mezo.org

🕊 X: https://twitter.com/MezoNetwork

🏦 Deposit Portal: https://mezo.org/hodl

ℹ️ Docs: https://info.mezo.org