What do Bitcoin holders want?

The question of what actually constitutes a “Bitcoin L2” has been the focal point of recent Bitcoin scaling conversations. However, the technical details of this argument matter little to the user.

Instead, the focus should be evaluating how the layers provide value to Bitcoiners (and non-Bitcoiners yet to onboard).

Many protocols focus on the wrong things and misunderstand what Bitcoin holders want.

Long-term BTC holders don’t want to spend their BTC—they want to grow their BTC holdings. So, building a network that creates scalable ways to spend BTC is inherently broken.

That’s why we’re focusing on giving BTC holders simple and easy access to:

- Yield

- USD Loans

Loans where you can see your collateral on-chain and dependable, real BTC yield provided by Mezo network activity.

Not your keys, not your yield

Even when Bitcoin holders are offered a simple way to spend BTC, they don’t want to. And why would they? Bitcoin is a hard asset that becomes more valuable over time. The goal should be accumulating as much BTC as possible and instead spending down a debasing fiat currency.

USD loans against Bitcoin collateral make it so long-term holders never have to sell their BTC.

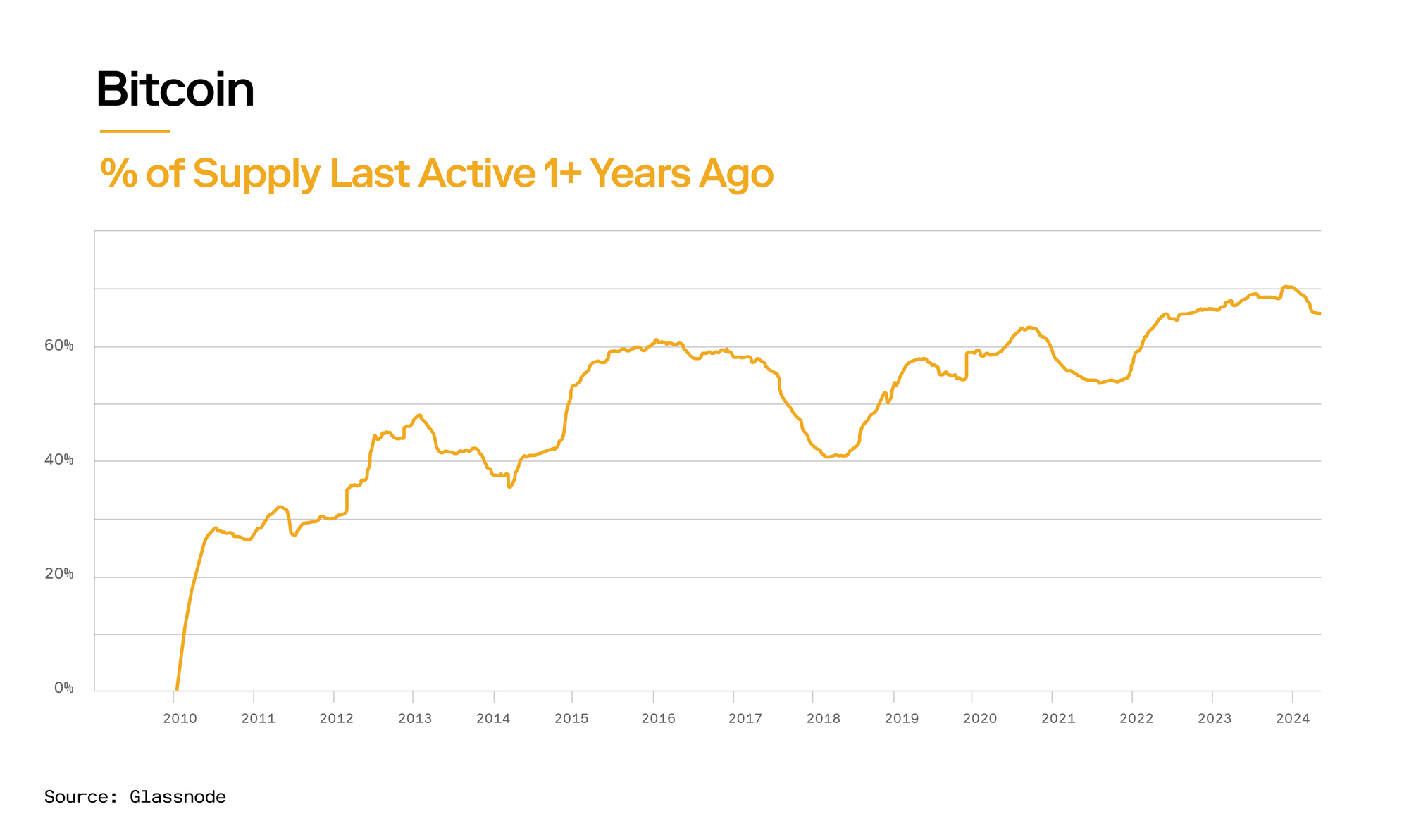

The idea of keeping your BTC has only grown throughout Bitcoin’s existence. The chart below shows the percentage of BTC supply that has not moved in over a year.

Peaking above 70% earlier this year and sitting at ~65% today, the long-term trend is clear—no one wants to spend their Bitcoin. They want to keep it.

Because of this well-known stat, lending is one of the most popular crypto businesses. Countless companies have seen great success by helping people unlock liquidity on their Bitcoin.

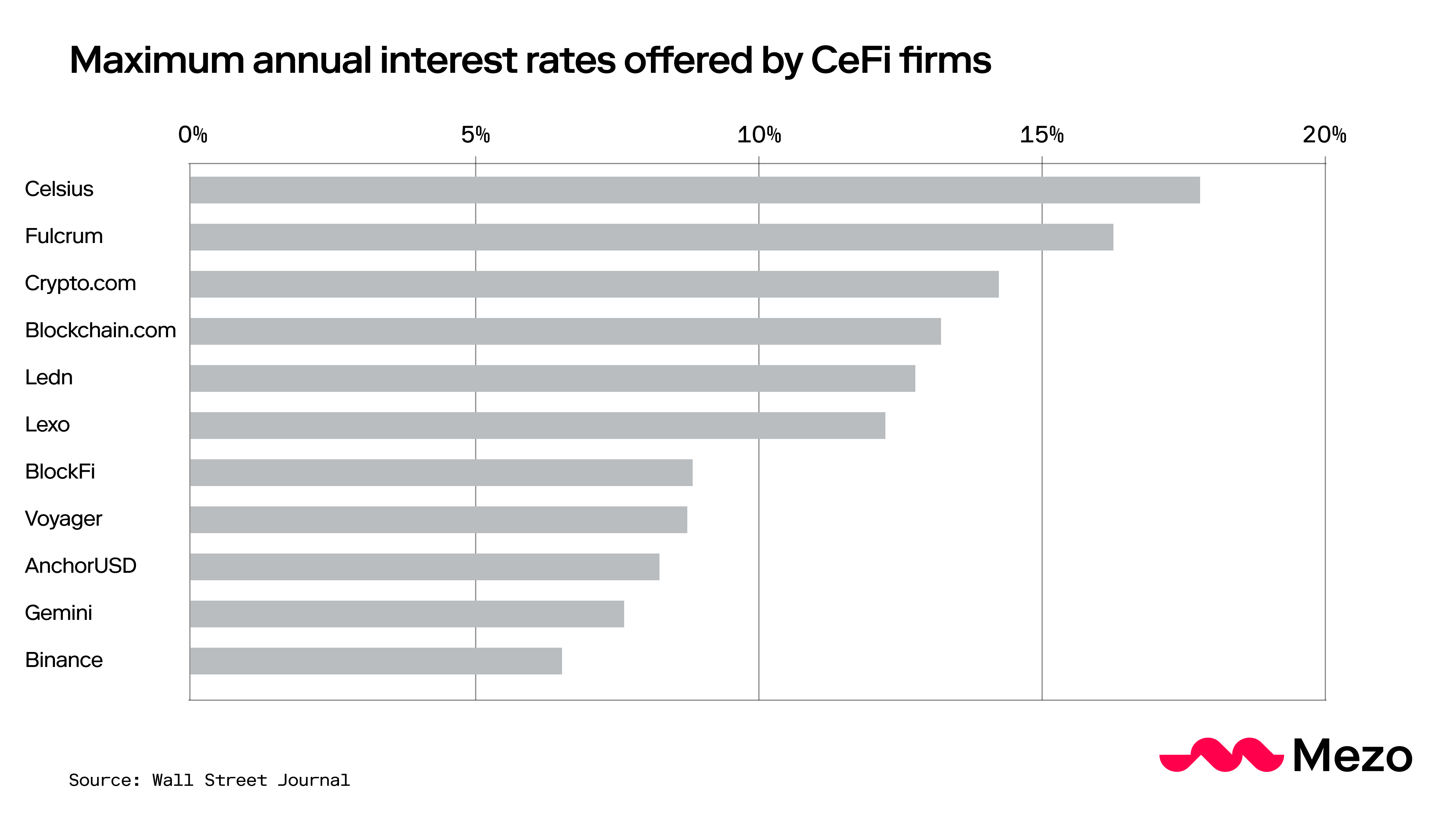

The problem is these companies are risk-taking and profit-driven, leading them to do sketchy things with their customers’ Bitcoin. Rather than build a simple and transparent platform for people to borrow against their BTC, they create additional products offering high yields on deposits.

But, this isn’t the clean yield found on-chain—it’s hyper-leveraged, black box models with no insight into what is going on behind the scenes (for example, the GBTC premium arbitrage).

Some firms still exist today, but many were wiped out in the 2022 contagion of FTX, Alameda, and 3AC.

BlockFi, Celsius, Voyager Digital, Genesis, and others show why centralized yield models are untrustworthy. These platforms accrued many billions in customer deposits through their yield offerings and lending platforms. But ultimately, giving up your BTC to some central actor is not the right way to access these products.

Consumers want BTC yield, but there isn’t an accessible place to get it. Yet.

We want to solve this by making it easy to get yield without compromising on security.

On-chain yield has not found PMF

Beyond centralized yield offerings, Ethereum has over four years of "Bitcoin yield" history. We can use this to understand how Bitcoiners use their BTC when trust-minimized applications are available.

wBTC, the original Bitcoin wrapper on Ethereum, launched in January 2019, deep in the bear market. However, its popularity didn't rise until DeFi Summer 2020, when people could borrow against their BTC or earn high double-digit yields.

Whether via liquidity provision or borrowing against BTC in a lending market, the DeFi boom allowed people to use their BTC in a completely new way. Demand for these products was strong, and wBTC supply exploded, peaking just below 300k BTC.

During DeFi Summer and the 2021 bull market, much of the on-chain BTC yield activity was more favorable for the degen. Yields have cooled, insecure models of wrapped BTC have been exploited, and new ways to use BTC have sucked wBTC liquidity out of Ethereum.

This has caused the wBTC supply to fall off and likely peak for good as holders prefer trust-minimized bridging models, like in tBTC.

However, sustainable sources of yield still exist, such as LPing on exchanges like Uniswap and Curve or lending on platforms like Aave and Compound. These platforms still hold most of the outstanding wBTC supply (~$10B or 150k BTC).

These products have two main offerings: yield on BTC or liquidity against Bitcoin.

So, despite the unwinding of highly leveraged trading strategies and lower yields, long-term wBTC holders are still productive with their Bitcoin.

Bringing value back to Bitcoin

BTC yield and USD loans have proven their demand. But the existing options don't work.

Centralized lending and yield models are value-misaligned. Run away from the SBFs and Mashinsky’s of the world.

Using wBTC on Ethereum does not add value to Bitcoin—BitGo is holding your Bitcoins, and transaction fees go to ETH stakers.

Thankfully, this gap can be solved with an Economic Layer built to support BTC and its long-term holders while giving users the two things that matter most: yield and liquidity.

So, rather than managing yield farming positions on Ethereum or trusting a banker to hold your coins, you can do it on Mezo.

Mezo will let you earn on your BTC, access liquidity, maintain ownership of your keys, and return excess value to Bitcoin. Join us.

Links:

👾 Discord: https://discord.mezo.org

🕊 X: https://twitter.com/MezoNetwork

🏦 Deposit Portal: https://mezo.org/hodl-with/curve

ℹ️ Docs: https://info.mezo.org