History of Stablecoins

Not all stablecoins are created equal. From fiat and algorithmic models to hybrid designs, many have failed due to weak collateral. This post explores why Bitcoin is the only antifragile, censorship-resistant foundation for a decentralized stablecoin, and why Mezo’s MUSD chose that foundation.

Stablecoins are not created equal, and the backing mechanism makes all the difference between reliability and catastrophic failure. Although stablecoins are supposed to offer a safe harbor from volatility, history reveals that stability without sound, battle-tested collateral is an illusion.

Today, we’ll dive into how stablecoins have been backed historically, review a few major stablecoin failures, and see why Bitcoin is the only scalable, censorship-resistant, antifragile collateral for a stablecoin. This is exactly why Mezo is building its entire ecosystem around MUSD. Use your Bitcoin to borrow MUSD at fixed, low rates. Permissionless, decentralized, and designed to withstand market turbulence

Evolution of Stablecoins

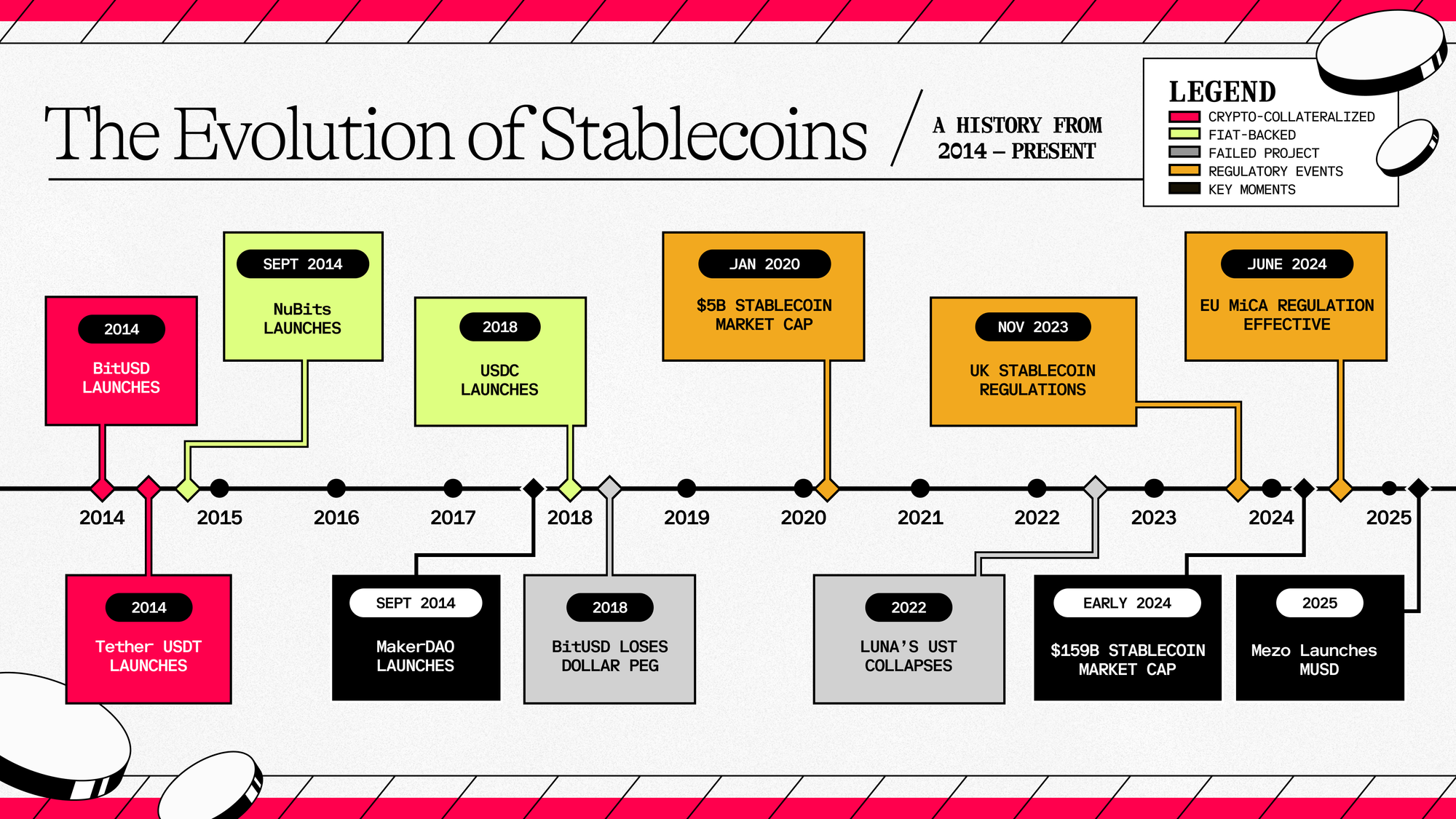

Stablecoins first emerged in 2014. This year zero introduced three noteworthy attempts: Tether (USDT), bitUSD, and NuBits. Tether became a global phenomenon, while bitUSD and NuBits didn't (we’ll discuss this more later).

In 2018, more stablecoins arrived. That year marked the widespread arrival of decentralized stablecoins, led by Maker’s DAI and Synthetix’s sUSD. Additionally, 2018 witnessed the second wave of centralized stablecoins like USDC, TrueUSD (TUSD), Gemini Dollar (GUSD), and Pax Dollar (USDP). The 2020s brought us Terra’s UST and the novel USDe. The field grew crowded. Some survived. Others did not.

Throughout their relatively short history, stablecoins have been backed by various assets, each with different risk profiles and reliability factors. Let’s examine the differences.

Fiat-Backed Stablecoins

The simplest approach is to back each stablecoin with fiat currency held in reserve. Examples include Tether (USDT) and USD Coin (USDC). These can hold a 1:1 peg if reserves are properly managed. While seemingly straightforward, this model introduces significant risks:

- Complete reliance on the legacy financial system

- Centralization risks with single points of failure

- Trust requirements that users will actually be able to redeem their tokens

For instance, Circle froze over $75,000 USDC linked to sanctioned Tornado Cash addresses. The sum is small, but the implication is large: USDC can unilaterally block access to funds, leaving all holders exposed to external control.

Algorithmic Stablecoins

The most experimental class relies on smart contract algorithms rather than hard assets. It often uses a dual-token system or dynamic supply adjustments. No collateral is held; instead, it trusts game theory and arbitrage to maintain the peg. This category includes infamous failures like Basis Cash, Empty Set Dollar, and TerraUSD. It promises so-called capital efficiency, but as we’ll see, it is fragile in practice.

Crypto-Collateralized Stablecoins (Non-BTC)

These stablecoins use other cryptocurrencies (like ETH) as collateral. Often, over-collateralization is required (e.g., 150% or more) to account for volatility. Sky Ecosystem’s USDS (fka as MakerDAO/DAI) is a notable example: once backed solely by ETH, it’s now predominantly collateralized by a mix of ETH, BTC, and USDC. Crypto-backed models remove fiat custody risk but inherit volatility risk, as a sharp drop in collateral value can threaten the peg. For example, in March 2020, a sudden ETH crash caused DAI to struggle until emergency measures were taken.

Hybrid / Partial Collateral

Some projects mix collateral with algorithmic elements. For example, Iron Finance’s IRON coin was ~75% backed by USDC and 25% by a volatile token (TITAN). Others, like Frax, combine fractional reserves with governance tokens. Partially collateralized tokens can scale much easier, as they help meet increasing demand without requiring an equal upfront cost in supply. However, this capital efficiency comes with tradeoffs - partial backing means partial trust. As a result, they often inherit the downsides of both worlds.

Until recently, Bitcoin was seldom used as direct collateral for stablecoins. Early attempts at stablecoins like BitShares’ bitUSD indirectly used BTC price exposure via BTS collateral, and projects like NuBits (2014) tried an algorithmic shares model. But a pure BTC-backed USD stablecoin was largely missing – a gap Mezo’s MUSD now fills.

Lifespan matters. When evaluating stablecoins, Lindyness is key. Tether is by far the longest-operating stablecoin, running continuously for more than 3,800 days despite periodic volatility. Bitcoin is the only Lindy cryptocurrency asset known, making it the ideal candidate for collateral reserve.

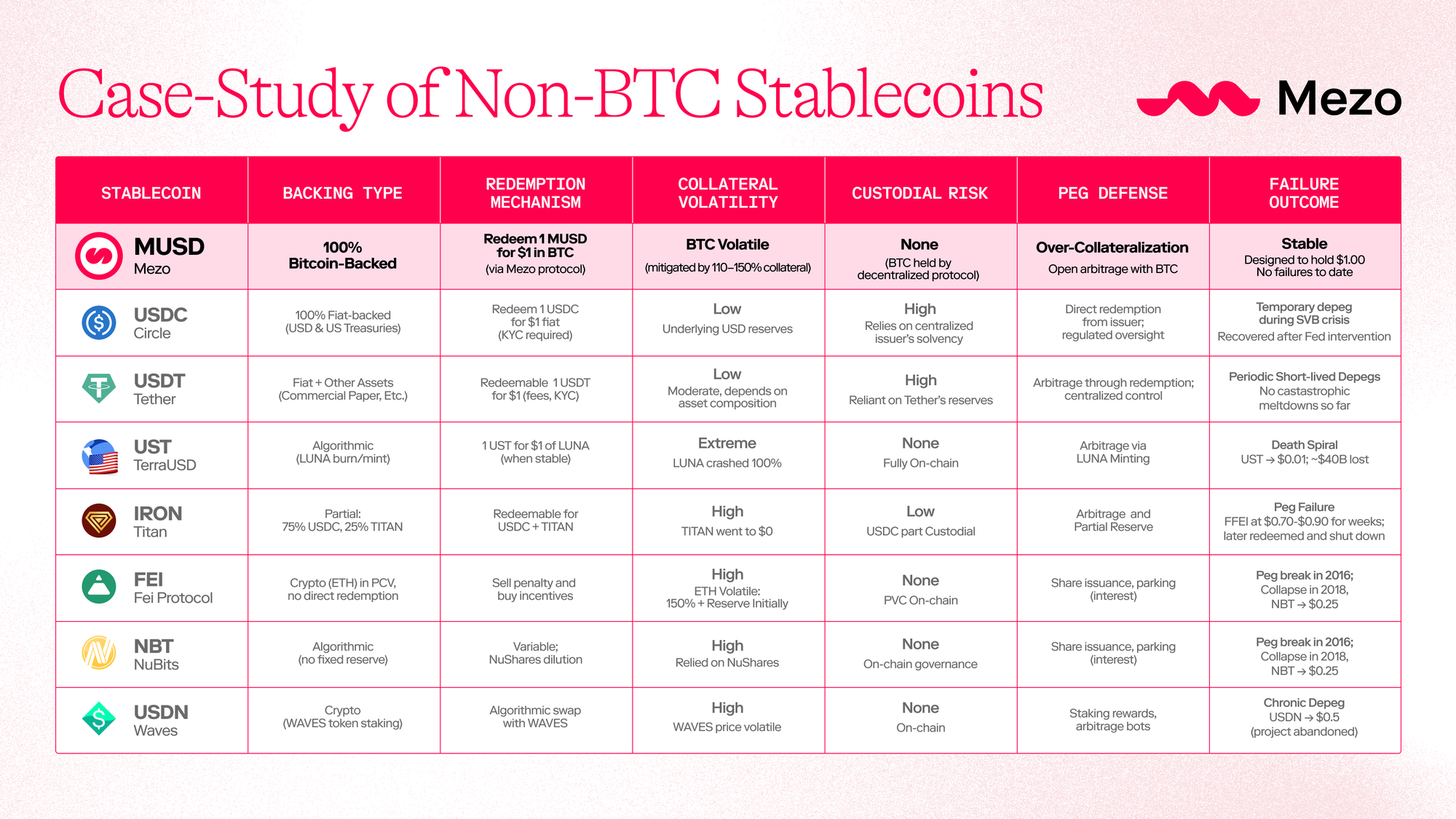

The Risks of Non-BTC Stablecoins: A Case Study

UST

One of the largest crypto failures ever was TerraUSD (UST) in May 2022. UST was an algorithmic stablecoin that maintained its peg through a sister token, LUNA. There was no hard collateral-backed UST, only the promise that 1 UST could be redeemed for $1 worth of newly minted LUNA. This worked during good times but created a deadly reflexivity in bad times.

In early May 2022, confidence in UST cracked. Massive withdrawals from Terra’s lending platform, Anchor, preceded a sell-off. UST began to wobble below $1. As arbitragers redeemed UST for LUNA, LUNA’s price started free-falling, which required minting even more LUNA to satisfy redemptions. This death spiral became unstoppable. Within days, UST plunged from $1 to barely a cent, and LUNA, once valued over $80/token, collapsed to near-zero, wiping out over $40 billion of value.

The fact of the matter is, UST had no real reserves. Its peg was propped up by faith in LUNA’s value and unsustainably high Anchor yields. When panic set in, the algorithmic peg defense (minting LUNA) triggered hyperinflation of LUNA and a total loss of confidence.

Could BTC backing have helped? Yes. If UST had been 100% Bitcoin-backed, real reserves would have been to absorb sell-offs. Unlike Terra's system, where attackers could undermine the entire stablecoin by targeting LUNA (the internal backing token), a Bitcoin-backed system would have been more resistant to such attacks. This is because Bitcoin exists independently of the stablecoin system, has much deeper liquidity, and doesn't share the same vulnerability to self-reinforcing collapse that plagued algorithmic tokens like LUNA. In fact, the Luna Foundation Guard scrambled to use ~$3 billion in Bitcoin reserves to defend UST, but it was too little, too late (UST was vastly under-collateralized). A fully BTC-backed UST would never have grown to $18B supply without equivalent reserves, preventing the death spiral in the first place.

Fei

Fei Protocol (FEI) launched in April 2021 with much fanfare and $1.2 billion in backing, aiming for a fully decentralized stablecoin. FEI used a Protocol Controlled Value (PCV) model: it raised ETH as collateral in a bonding curve sale, and the protocol itself managed those reserves. Instead of allowing direct redemption of FEI for ETH, Fei used incentives to keep FEI at $1. For example, if FEI traded below peg, selling FEI would incur a penalty (burn). The idea was to discourage selling and push the price back up.

Unfortunately, Fei’s mechanism backfired at launch. FEI quickly lost its $1 peg (trading as low as $0.71) and the algorithmic incentives trapped users: selling FEI incurred high penalties, so many were stuck holding FEI below $1 with no arbitrage outlet. This led to an outcry as users felt imprisoned and punished by the protocol’s rules. Over its first month, FEI consistently traded well under $1 despite the protocol holding ample ETH reserves. It turns out complex incentives != a stable peg. In fact, each intervention made things worse. The team eventually adjusted the mechanism and FEI did reach near-parity, but the damage to confidence was done.

Fei’s struggles continued into 2022. In April 2022, a hack of Fei’s Rari Capital pools drained ~$80 million. By August 2022 the project announced it would wind down FEI stablecoin entirely.

In this case, Fei’s model was over-engineered. It had collateral (ETH) but didn’t allow direct redemption, relying instead on behavior-modifying incentives that failed to maintain the peg . FEI was not fully collateralized at the margin. When market stress occurred, users had no way to claim the underlying ETH directly, leaving the peg without critical arbitrage support. The governance-controlled collateral also introduced centralization and exploit risk (as seen in the hack).

The key issue was that Fei's system relied on abstract incentives rather than direct redemption rights. When those incentives failed during market stress, users were trapped. A BTC-backed system with guaranteed redemption would have given users confidence that their holdings maintained real value regardless of market conditions. Fei tried to reinvent financial stability through complex mechanisms when the simpler solution (hard collateral with direct redemption rights) has proven more effective throughout history. TLDR: either you have reliable, accessible collateral, or you don't.

Decentralized stablecoins rely on market psychology. They assume the market will always pull prices back to $1, driven by the question, “Why would it trade elsewhere?” In reality, this assumption cracks under pressure. Early projects like BitShares’ bitUSD lacked strong oracle feeds and external price references, so they wobbled.

Each of these failures (and many others) share a common theme: insufficient reliable collateral. Whether it was an altcoin meant to algorithmically support the peg, or a fractional reserve that ran dry, the result was a broken peg and losses for users.

Had these projects been backed 1-for-1 by BTC, the story would likely be very different. Even when hacks or external events struck, solid reserves could have absorbed the shock or allowed an orderly wind-down with redemptions (as opposed to a total collapse).

Why Bitcoin-Backed Stablecoins Are Antifragile

After witnessing so many failures, one might wonder if a truly stable, decentralized stablecoin is even possible. The recurring theme was lack of a solid foundation. Bitcoin provides that foundation. Here’s why:

- Censorship-Resistance: Bitcoin is permissionless and decentralized. No government or bank can freeze a UTXO without controlling the keys. A BTC-backed stablecoin inherits this property, i.e.: there is no centralized issuer who can be pressured to blacklist users. In contrast, regulators easily compelled Circle to freeze USDC funds.

- Deep Liquidity & Adoption: Bitcoin is the largest cryptocurrency. Using BTC as collateral means an asset with global demand and liquidity backs your stablecoin. This scales far better than backing with niche tokens or fragile algorithms. As Bitcoin’s value grows, so does the collateral base for BTC-backed stablecoins.

- Antifragility: Bitcoin has survived countless shocks (exchange hacks, nation-state bans, forks, bear markets) and always bounced back. It is often called antifragile because stress seems to strengthen the network in the long run. A stablecoin anchored in BTC inherits some of this robustness. There’s no equivalent hardening for stablecoins tied to, say, a new DeFi token (which can go to zero) or a fiat in a bank (which can fail or get seized). Bitcoin is hard money. Over a 14-year history, BTC has proven reliable, a farcry to the 14-month average life of unbacked stablecoin experiments.

- Transparency: BTC-backed stablecoins allow for real-time verification of reserves (e.g., publishing proof-of-reserves addresses). MUSD, for instance, can prove that for every MUSD in circulation, the protocol holds the corresponding BTC in reserve on the Mezo network. This contrasts with opaque fiat stables (Tether’s historical reserve ambiguities) or convoluted algorithmic setups no one fully understands. Transparency builds trust, which reinforces stability.

- Predictable Supply Dynamics: With a BTC-backed model, there are no surprise token mints or complex contraction mechanisms. Supply expands and contracts based on user demand and collateral deposits/withdrawals. This is straightforward and market-driven. It avoids the reflexive death spirals seen in algorithmic coins (where increased supply signals failure and triggers panic). If anything, a BTC-backed stablecoin becomes more secure as demand grows since more BTC flows into collateral vaults, making it even harder to destabilize.

Critics might point out that Bitcoin itself is volatile. How can a volatile asset back a stablecoin? The answer is over-collateralization and management. Mezo’s MUSD, for example, requires a minimum 110% collateral ratio and recommends 150%. If BTC’s price drops too much, automated liquidations occur to keep the system solvent. MUSD combines Bitcoin’s strength with risk controls inspired by MakerDAO’s time-tested model. However, unlike Maker, MUSD doesn’t dilute its collateral quality. It uses pure BTC, not a mix of tokens and centralized IOUs.

MUSD: Built Different

MUSD stands apart by having pure, hard collateral (Bitcoin) and a straightforward redemption mechanism. Every MUSD is over-collateralized with BTC and can be redeemed for BTC value. This means:

- No new altcoin to collapse: MUSD has no secondary token like LUNA or TITAN that could implode. BTC is the only collateral, and BTC’s volatility is managed by requiring 110–150% collateral ratios (even if BTC price swings, MUSD stays backed).

- No custodial single-point failure: Unlike fiat-backed stablecoins relying on banks (which led to USDC’s depeg to $0.88 when Silicon Valley Bank collapsed), MUSD’s BTC reserves are secured programmatically on-chain. Outside entities cannot freeze them and are transparent.

- Market-driven peg maintenance: If MUSD trades below $1, arbitragers can buy it cheap and redeem it through Mezo for $1 in BTC (or repay BTC loans), pocketing profit and pushing the price back to $1. If it trades above $1, users are incentivized to deposit BTC and mint new MUSD (since each MUSD represents $1 of BTC), increasing supply and pushing the price down. These natural market forces defend the peg without any discretionary intervention.

MUSD does not rely on trust or algorithmic magic. Instead, it relies on Bitcoin's intrinsic value and the market's efficiency. This model directly addresses the failures that brought down other stablecoins.

Bitcoin is the Only Stablecoin Collateral

When you survey the stablecoin landscape, a pattern becomes crystal clear. The farther a stablecoin strays from hard, verifiable collateral, the greater the risk of collapse. Fiat-backed coins carry legal and custodial risks. Algorithmic coins carry structural and reflexivity risks. Altcoin-collateralized coins carry correlation and liquidity risks.

Bitcoin-backed stablecoins solve or mitigate all these issues. Bitcoin is neutral, universally recognized, and provably scarce. It doesn’t depend on any issuer’s promise (unlike fiat). It doesn’t vanish in a market panic (unlike an algorithmic governance token). It isn’t someone’s liability or subject to seizure. If one believes Bitcoin is digital gold or hard money, then a BTC-backed stablecoin is akin to a digital gold standard for the digital dollar. It leverages the best that crypto has to offer (decentralization & transparency) to fix the flaws of volatile stablecoins.

Mezo’s MUSD is a product of lessons learned. By using Bitcoin as sole collateral, MUSD offers unmatched stability. In times of turmoil, people flock to safe assets. In crypto, the safest asset is Bitcoin. Pegging a stablecoin to the dollar but backing it with Bitcoin yields a powerful combination: the unit-of-account stability of USD + the trust-minimized soundness of BTC.

The failures of UST, IRON, FEI, and others were painful for the industry, but they taught us what not to do. Don’t rely on alchemy when physics will do. The physics, in this case, is simple: one stablecoin, fully backed by one immutable asset. MUSD’s model is simple, and that’s its strength. In the end, the only scalable, censorship-resistant, antifragile foundation for a stablecoin is Bitcoin itself, and MUSD turns the hardest money into the safest stable money.

The road to banking on yourself starts with borrowing on Mezo.

👉 Start Today:

Join the Community:🕊 X (Twitter) | 📣 Telegram