MUSD: The Bitcoin-Backed Stablecoin That Lets You Borrow, Spend, and Save Without Selling

MUSD is a Bitcoin-backed stablecoin that lets BTC holders unlock dollar liquidity without selling. Borrow, spend, and save—all while preserving Bitcoin exposure and gaining autonomy from fiat rails.

Money needs tools to be useful. Bitcoin has remained relatively muted as a form of payment simply because holders are reluctant to part with an asset they believe will appreciate. Yet dollar liquidity remains a practical, real-life necessity. MUSD creates a new mode of economic agency. Bitcoiners can finally act like sovereign treasuries by borrowing, spending, and saving on their terms. Let’s explore why Satoshi would’ve loved MUSD.

Dollar Liquidity Without Dollar Exposure

Most Bitcoin holders want to maintain their BTC position. They don't want to exit to fiat. However, the reality is we still live in a fiat-dependent society. As a result, Bitcoiners often need dollar-denominated liquidity for payments, expenses, and opportunities.

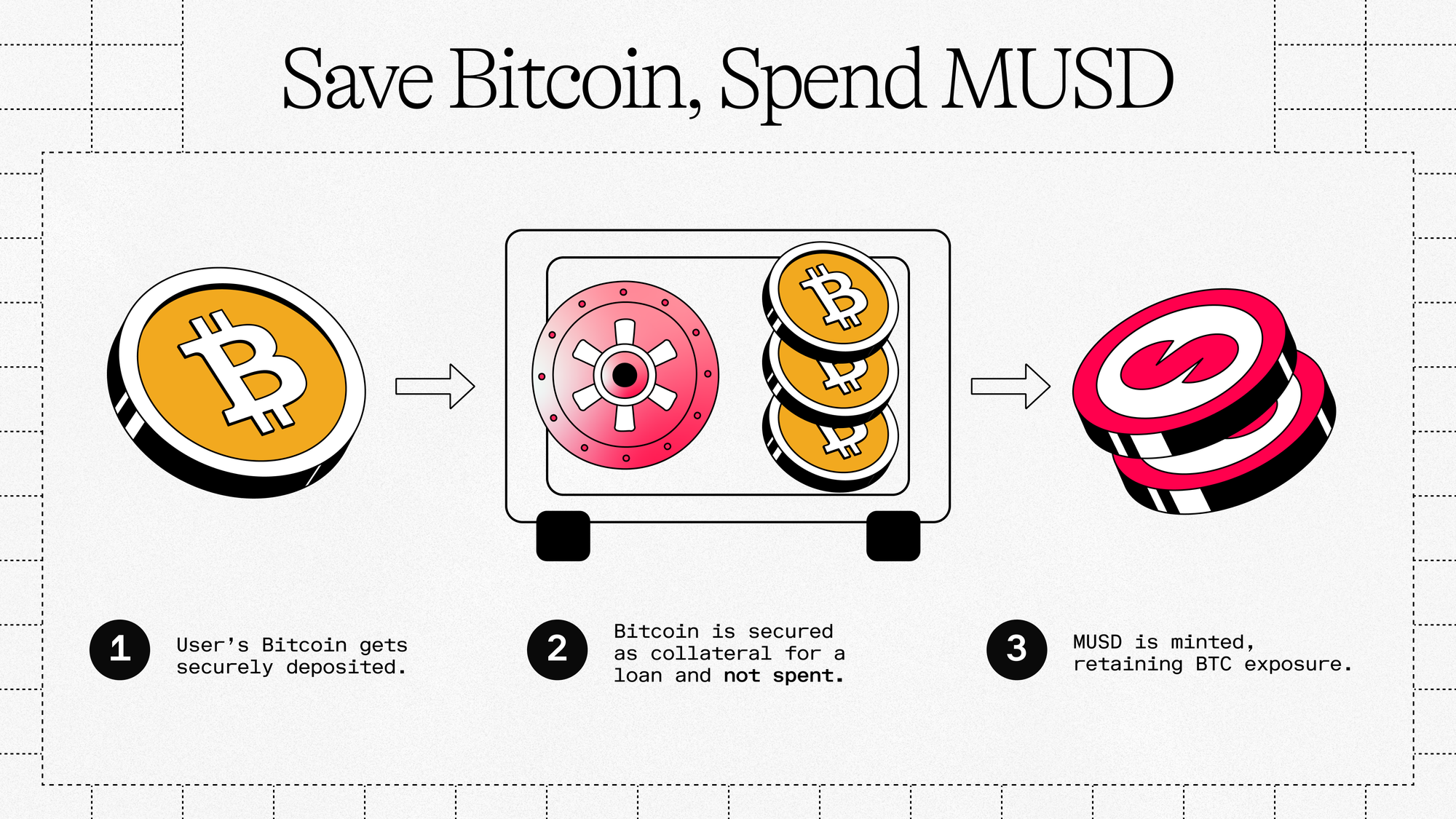

MUSD solves this problem by providing dollar liquidity without requiring users to sell their Bitcoin. By supplying BTC as collateral, Bitcoiners mint MUSD and gain short-term purchasing power while maintaining long-term Bitcoin exposure. This grants dollar liquidity without turning to traditional financial institutions, enabling Bitcoin to serve everyday needs while staying fully within the Bitcoin economy.

Holding BTC Creates a Personalized Liquidity-Preference Curve

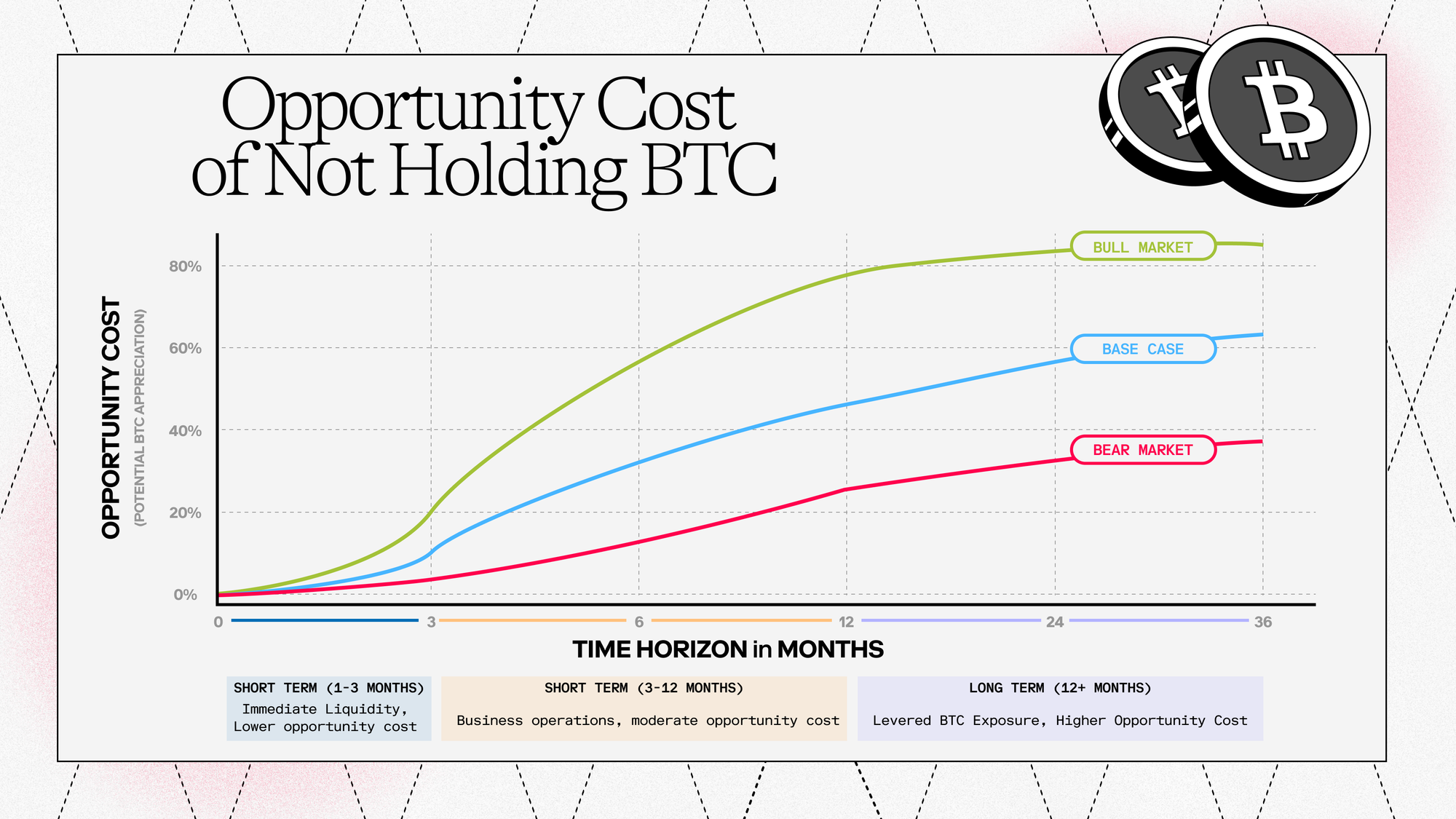

When Bitcoin holders lock their BTC to mint MUSD, they transform a previously idle asset into a dynamic one without sacrificing custody or long-term ownership of their Bitcoin. This creates an economic framework where Bitcoin holders quantify the time-value relationship between BTC collateral and dollar liquidity.

Unlike selling BTC directly for fiat (which permanently reduces one’s exposure), minting MUSD maintains BTC exposure and custody rights and allows redemption at any time by repaying the minted amount.

This concept resembles the liquidity-preference theory described by economist John Maynard Keynes, which explains how investors balance immediate liquidity against potential long-term returns. Specifically, Keynes outlines three key motives for holding liquid assets:

- Transaction motive: Bitcoiners mint MUSD to meet immediate and practical liquidity needs without having to liquidate their BTC holdings. This motive prioritizes MUSD's convenience and immediate purchasing power, just like holding cash for everyday expenses.

- Precautionary motive: Minting MUSD creates a financial buffer against Bitcoin's price volatility. Bitcoin holders retain exposure to potential BTC appreciation, yet simultaneously guard against short-term volatility by having immediate access to stable liquidity.

- Speculative motive: Bitcoiners mint MUSD continue to retain exposure to BTC. By choosing not to sell outright, they speculate on the potential for future appreciation. Holding BTC as collateral allows users to capitalize on expected price movements without sacrificing present liquidity, creating a balance between immediate financial needs and speculative ambitions.

MUSD holders are essentially creating their own liquidity-preference curve, continuously deciding how much liquidity to hold relative to their future expectations of BTC appreciation. This model effectively allows borrowing from your future BTC self.

Implications

Understanding why holders seek MUSD liquidity allows us to redefine how they measure its cost and manage operations natively within a Bitcoin framework. As a result of MUSD, financial thinking naturally shifts towards Bitcoin-centric terms. Risk, traditionally measured in abstract percentage points by external financial systems, can now be intuitively understood by the holder as sats foregone, or the potential Bitcoin value implicitly sacrificed over time for present dollar liquidity.

This clarity in cost analysis, combined with the core MUSD function of leveraging BTC without selling, unlocks tangible advantages across the Bitcoin ecosystem:

- Miners: Gain critical operational flexibility. Instead of being forced to sell BTC production during market downturns to cover ongoing expenses, miners can borrow MUSD against their holdings. This preserves their exposure to Bitcoin's potential upside while providing necessary working capital. The cost of this capital can be evaluated directly in terms of future Bitcoin production foregone.

- Startups and Builders: Can maintain strategic, long-term Bitcoin treasuries while using MUSD for predictable, dollar-denominated operating costs such as salaries, rent, and services. This avoids constant conversion between BTC and fiat, simplifies accounting within a Bitcoin-centric model, and allows budgeting directly against their core asset base.

- Savers: Access a stable yield mechanism intrinsically linked to the Bitcoin ecosystem. By allocating MUSD to integrated savings protocols that utilize Mezo incentives (like mats and veBTC), holders can achieve returns denominated relative to Bitcoin. This offers a pathway to predictable, Bitcoin-native yield.

Satoshi Nakamoto envisioned a peer-to-peer electronic cash system that bypassed traditional middlemen to grant individuals true monetary independence. MUSD delivers a vital tool built upon that foundation. It provides a stable, Bitcoin-backed unit that allows holders to finally use their sovereign assets for real-world needs without needing permission from legacy systems or exiting the Bitcoin ecosystem.

That’s why he would’ve loved it.

Far from being a run-of-the-mill loan product, MUSD is the key to enabling the circular Bitcoin economy we are so fond of discussing. Bitcoin holders transition from passive participants in financial markets to active architects of their economic destinies, managing liquidity, investment, and stability on their own terms. All done, through MUSD.

The road to banking on yourself starts with borrowing on Mezo.

👉 Start Today:

Join the Community:

🕊 X (Twitter) | 📣 Telegram

MUSD FAQs

- What Does “Buy Now, Pay Never” Actually Mean?

“Buy Now, Pay Never” refers to the flexibility of taking out an MUSD loan against your Bitcoin collateral without a set repayment deadline. You can repay when you choose, provided your collateral ratio remains above the required threshold, initially set at 110%. This doesn't eliminate the need to stay above liquidation ratios or to pay accumulated interest, but it removes the pressure of a typical repayment schedule.

In theory, as your Bitcoin collateral increases in value, you can use the increase to pay down your outstanding debt obligation.

- Are there any hidden fees?

No. The known fees include:

- Interest Rate (1%–5% fixed APR for the life of the loan).

- Gas Fees for blockchain transactions, depending on the network.

- Refinancing Fees in cases where you change loan terms.

- Redemption Fee (0.5%) for converting MUSD back to BTC when you have no existing loan. Converting MUSD to BTC when you have an existing loan incurs no additional redemption fee.

If new fees are introduced in future updates, they will be transparently disclosed.