How MUSD Works and Why It's Stable

MUSD is Mezo’s 100% Bitcoin-backed stablecoin, letting users unlock dollar liquidity without selling BTC. Backed by CDPs, over-collateralization, and smart contract liquidations, MUSD stays pegged to $1. MUSD brings the power of everyday spending and DeFi to Bitcoin holders.

MUSD is Mezo's native USD-pegged stablecoin. Designed to maintain a consistent value of 1:1 with the US dollar and backed entirely by Bitcoin reserves, MUSD enables users to tap into dollar liquidity without divesting their Bitcoin holdings. This capability unlocks the inherent economic value within Bitcoin without requiring holders to divest from their BTC position.

But how does MUSD really work and, more importantly, how can a stablecoin backed entirely by volatile Bitcoin maintain a stable $1 peg?

How MUSD Works & What is a CDP?

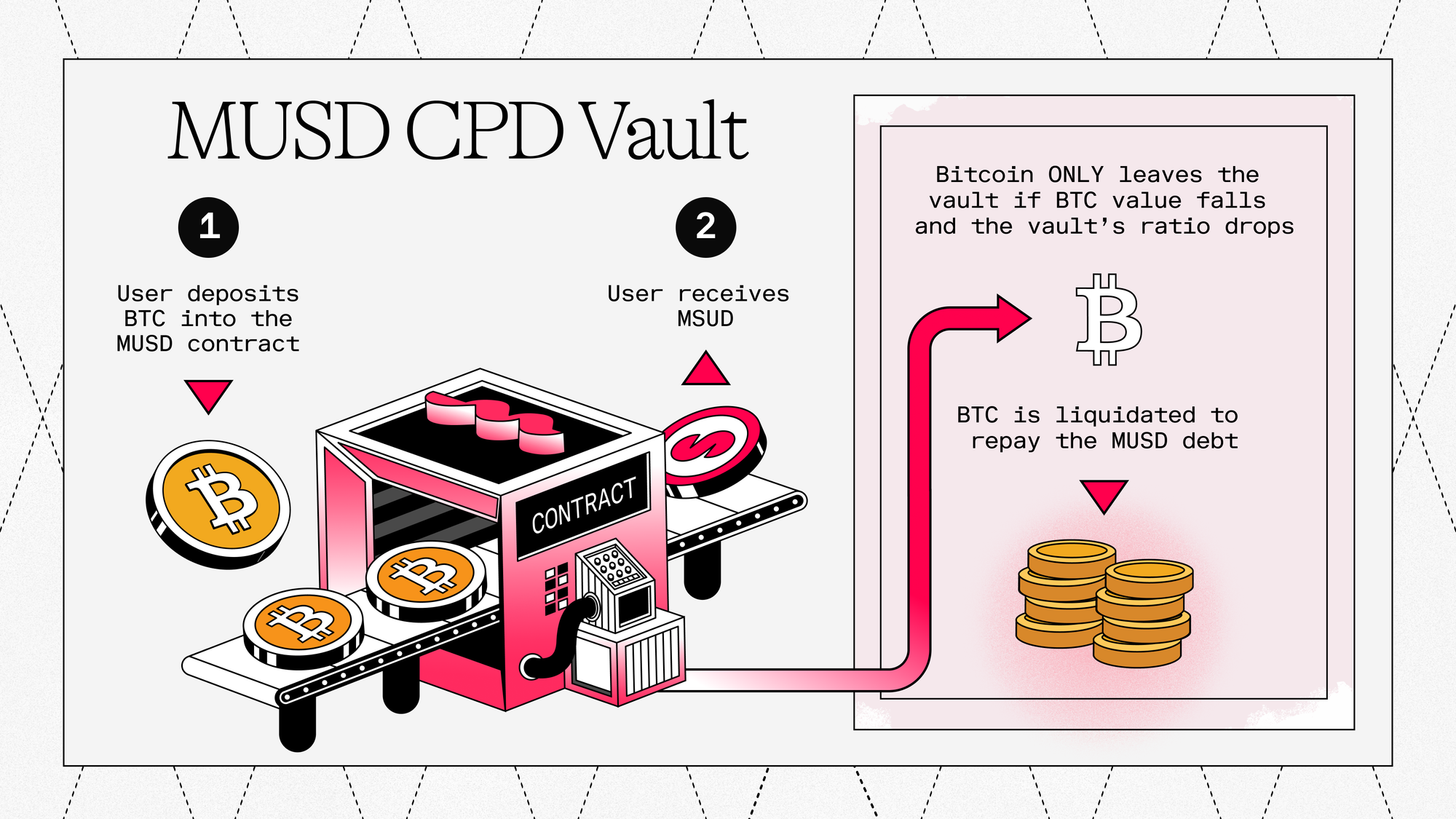

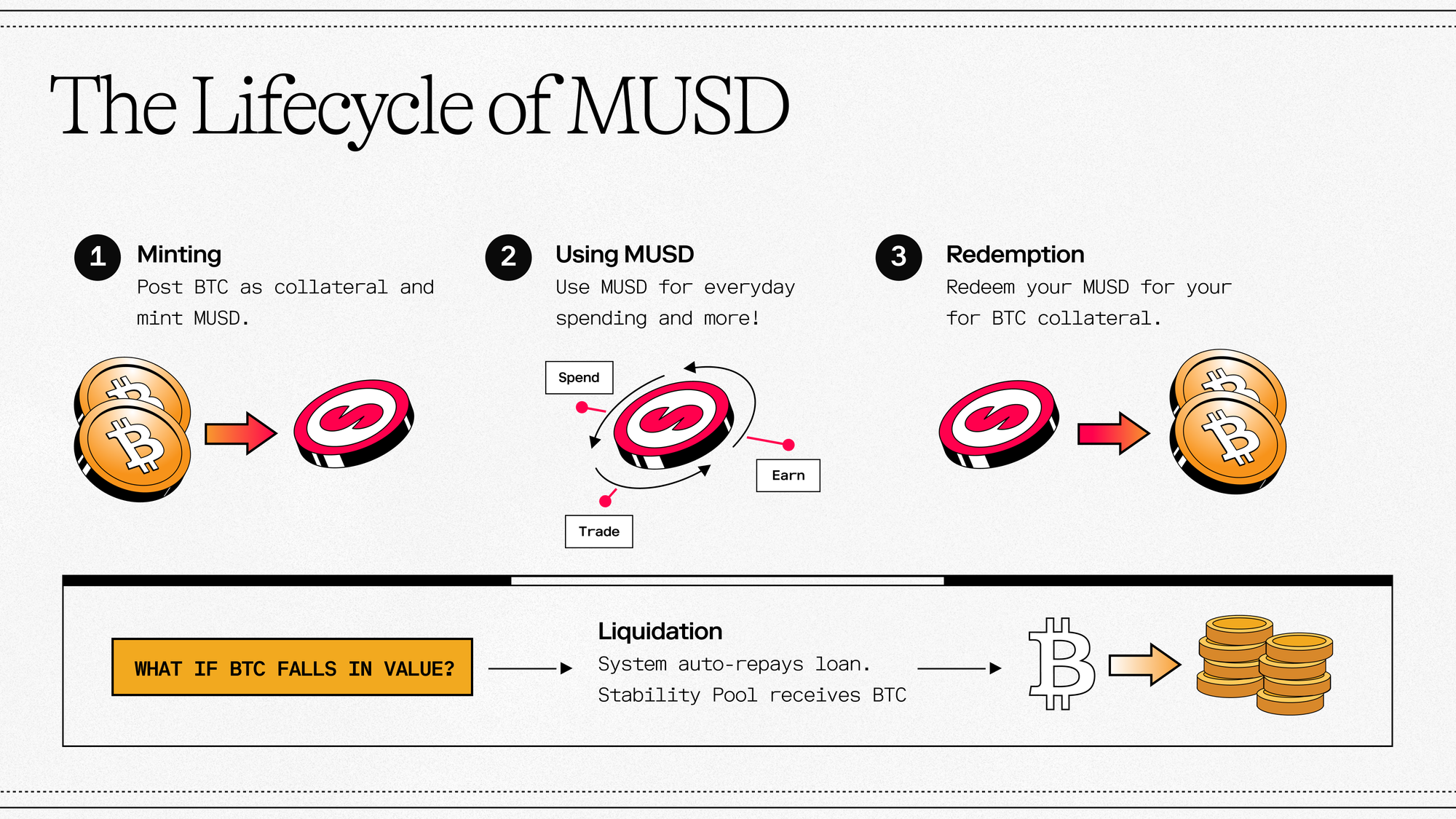

MUSD operates through a Collateralized Debt Position (CDP) mechanism.

In a CDP, you lock up collateral and borrow a lesser amount of a stablecoin against it, creating a debt position. With MUSD and the Mezo Borrow system, users deposit Bitcoin as collateral into a smart contract and mint MUSD, effectively taking out a loan denominated in the stablecoin. Each MUSD is redeemable for $1 worth of BTC at any time. To close out your position (pay back the loan), you simply return the MUSD you borrowed (plus any interest), and you get your Bitcoin collateral back.

Importantly, the system is permissionless and non-custodial. Mezo is built on top of the tBTC bridge. tBTC is a decentralized tokenized version of Bitcoin (an ERC-20 token) that is fully backed 1:1 by real BTC. It’s produced by the Threshold Network’s proven bridge infrastructure (operating since 2020 with public audits and proof-of-reserves).This means when you deposit real BTC, it’s converted into an equivalent tBTC in Mezo’s system, allowing the protocol to use your BTC in DeFi contracts while remaining verifiably backed. By using tBTC, MUSD ensures that real, onchain BTC reserves anchor all circulating stablecoins, and you can view the collateral onchain anytime.

Mezo Borrow & How CDP Works

To understand a CDP, it can be likened to a secured loan. In a traditional secured loan, an individual borrows funds by providing an asset of value, known as collateral, to the lender. This collateral acts as security, allowing the lender to seize and sell it if the borrower fails to repay the loan. With blockchains, a CDP operates on similar principles but is executed through smart contracts, making the entire process transparent, automated, and free of any third parties.

A critical aspect of a CDP is the collateralization ratio. This ratio is a measure of the value of the collateral provided compared to the amount of debt borrowed. For instance, a collateralization ratio of 110% means that for every $100 worth of MUSD borrowed, a user has deposited $110 worth of Bitcoin as collateral. If the value of the deposited Bitcoin collateral experiences a significant decline, causing the collateralization ratio to fall below a dynamically determined threshold, the CDP is automatically liquidated. This process involves selling the collateral (in this case BTC on Mezo) to repay the outstanding MUSD debt, ensuring that the system remains solvent and that each MUSD is adequately backed. The CDP model is not unique to MUSD and has been successfully implemented by other stablecoins, such as DAI, where users deposit cryptocurrencies like Ethereum to mint DAI. However, what distinguishes MUSD is that it is the first to have Bitcoin as its sole backing asset.

How MUSD Maintains Its Peg

MUSD's stability as a Bitcoin-backed stablecoin relies on a robust, multi-layered system designed to keep its value firmly anchored at $1, even with Bitcoin's volatile nature. Unlike traditional fiat-backed stablecoins that maintain their peg through bank deposits, MUSD employs several interrelated mechanisms that work together to ensure price stability.

Over-Collateralization

Over-collateralization in Mezo means every MUSD loan must be over-backed by more BTC value than the debt issued. To mint MUSD, you must post at least 110% collateral. In other words, for every 100 MUSD you borrow, you need at least $110 worth of Bitcoin locked up. This 110% is a minimum. In practice, users might want to maintain a higher ratio (e.g., 150% or more) to be safe and account for Bitcoin’s price fluctuations (more on this in the section below).

Over-collateralization creates a buffer so that even if Bitcoin’s price dips, the loan remains fully backed by enough BTC. It is the key to how MUSD can use a volatile asset yet maintain a stablecoin peg. Even major lending platforms like MakerDAO or Aave require such buffers for ETH or WBTC. Mezo has set a relatively low minimum (110%) to make borrowing more capital-efficient, which is balanced by robust liquidation mechanisms.

The protocol continuously monitors each loan’s ratio (called the Individual Collateral Ratio, ICR). If your ICR falls below the minimum (110%), your position is deemed under-collateralized and is subject to liquidation. Over-collateralization ensures every MUSD is backed by more than $1 worth of Bitcoin, giving the system time to liquidate risky loans before they fall below full backing. This also means that MUSD is always fully backed by BTC reserves on a system-wide level. Every MUSD in circulation has more than $1 of Bitcoin behind it at all times.

Automated Liquidations and the Stability Pool

Liquidation is the process that kicks in when a loan’s collateral is insufficient. Rather than let an under-collateralized loan linger (which could leave some MUSD unbacked), the system will automatically close the position by selling off or redistributing its BTC collateral to cover the outstanding MUSD debt.

Additionally, MUSD uses a Stability Pool mechanism to handle liquidations swiftly and decentralize the process. This is a special pool where MUSD holders can deposit their stablecoins as a backstop for the system. When a loan is liquidated, the Stability Pool steps in to repay the debt: it burns an equivalent amount of MUSD from the pool to cancel the liquidated loan’s debt, and in exchange, it receives the BTC collateral from that loan. Essentially, the pool absorbs the bad debt and takes the Bitcoin, ensuring the broader MUSD supply remains fully backed. Stability Pool depositors (called stability providers) lose some of their MUSD (used to pay others’ debts) but gain the liquidated BTC collateral as compensation. Because liquidations are engineered to happen when collateral is just slightly above the debt value (typically at 110% of debt), stability providers usually gain more value in BTC than the MUSD value they lose.

Anyone can add or withdraw MUSD from the Stability Pool at any time, so this pool liquidity is dynamic. If the Stability Pool ever runs out (say, many liquidations exhaust it), MUSD has a second line of defense called redistribution. In that scenario, any remaining debt and collateral from liquidated loans are spread across all active borrowers in proportion to their own collateral. In effect, other vaults would automatically take on a bit of the debt and a corresponding bit of BTC collateral. This mechanism ensures no debt is left unbacked even in extreme events. This is a decentralized way to “socialize” the rare case of Stability Pool depletion so that the system remains whole without any bailouts.

Arbitrage

Even with full backing and liquidations, a stablecoin’s market price can deviate from $1 due to supply and demand. MUSD employs the same proven market mechanism that keeps coins like DAI and LUSD anchored: arbitrage.Arbitrage means traders will buy or sell MUSD in the open market whenever it drifts from $1, because they can profit from bringing it back to parity. MUSD's design makes such arbitrage possible and economically attractive, so the peg essentially maintains itself through traders’ self-interest.

Here’s how it works, in two scenarios:

If MUSD trades below $1

This is a “discount” situation, as the stablecoin is cheap relative to its peg. Arbitrageurs can buy MUSD on the market at that discounted price and then redeem it with the Mezo protocol for $1 worth of BTC per MUSD. Since each MUSD is always redeemable for $1 of Bitcoin, buying MUSD below $1 and exchanging it for BTC yields an instant profit.

For example, if MUSD fell to $0.95, a trader could buy 1,000 MUSD for $950 and then redeem them to the protocol for $1,000 in BTC, netting a $50 gain (minus any fees). This arbitrage demand (people buying up cheap MUSD to get more BTC value) pushes MUSD’s market price back up toward $1. In MUSD’s case, users who already have a loan position can redeem MUSD for their collateral with no additional fee, making it very efficient to arbitrage by repaying your own debt at a discount.

Even users without an existing loan can perform a direct redemption; they just pay a small redemption fee (currently 0.5%) to the protocol. That 0.5% fee slightly reduces the profit for external arbitrageurs, but it still leaves plenty of room if MUSD is more than 0.5% below peg. In fact, this fee sets a floor price of about $0.995 for MUSD. If MUSD ever traded lower than $0.995, an arbitrager could profit by buying and redeeming despite the fee, so they would do so until the price is back up near $1. As a result, MUSD is unlikely to drop significantly below $1 for long because snapping it up at a discount is an almost risk-free profit opportunity.

If MUSD trades above $1

This is a “premium” situation, as MUSD is expensive relative to its peg. Arbitrageurs can take the opposite action: mint new MUSD at the $1 rate by depositing BTC as collateral, and immediately sell that MUSD on the market for the higher price.

For instance, if MUSD is $1.05, a user can deposit some Bitcoin into Mezo, borrow 10,000 MUSD worth $10,000 in debt obligation, and then sell those 10,000 MUSD for $10,500 in another stablecoin or cash. Now they have $10,500, and only owe $10,000 plus interest to the protocol. They could later buy back 10,000 MUSD when the price falls back to $1 to repay, pocketing the $500 minus any small fees or interest.

By doing this (minting and selling), these traders increase the supply of MUSD on the market, which pushes the price down toward $1 as more MUSD is available for sale. They will keep doing this arbitrage cycle until the market price of MUSD returns to the peg (because above the peg, it’s profitable to mint and sell, which naturally corrects the price).In both cases, the peg is restored by market participants seeking profit: buy low and redeem, or borrow (mint) and sell high. What’s crucial is that the protocol honors the $1 exchange rate on the back end by letting you redeem 1 MUSD for $1 of BTC, and mint new MUSD against BTC at roughly $1 cost (aside from interest).

MUSD’s architecture guarantees those $1 conversions, so traders can rely on them. This is very similar to how DAI maintains its peg, but with Bitcoin as collateral instead of Ethereum.

As a result of these dynamics, MUSD’s market price should stay very close to $1. If it drifts even a few cents off, arbitrage quickly brings it back. Mezo only charges that 0.5% fee on redemptions for external users (and a similarly small one-time fee or low interest for borrowing), which is enough to prevent oscillations or abuse, but small enough to keep the peg tight within a narrow band.

Dollar Liquidity for Bitcoin Holders

MUSD will be the first, truly 100% Bitcoin-backed stablecoin. MUSD lets you hold onto your BTC and use dollars for daily needs or DeFi opportunities.

By using over-collateralized CDPs, automatic liquidation via the Stability Pool, and market-driven arbitrage, Mezo’s MUSD maintains its peg to $1. Each MUSD is always redeemable for $1 worth of Bitcoin, and that guarantee, enforced by transparent onchain reserves, is what anchors trust in the system.

Bitcoin holders can thus unlock the value of their BTC without selling it, accessing liquidity to spend or invest in the dollar economy while still keeping their long-term BTC exposure.

Because the entire system is built on Bitcoin’s value, it aligns with the ethos of financial sovereignty. You’re effectively banking on yourself, using your BTC to create your own dollar liquidity and never having to exit your BTC position to interact with the fiat world.

Try MUSD today on the Mezo Testnet and stay tuned for more news, as we make our way to Mezo Mainnet.

MUSD FAQs

- What Does “Buy Now, Pay Never” Actually Mean?

“Buy Now, Pay Never” refers to the flexibility of taking out an MUSD loan against your Bitcoin collateral without a set repayment deadline. You can repay when you choose, provided your collateral ratio remains above the required threshold, initially set at 110%. This doesn't eliminate the need to stay above liquidation ratios or to pay accumulated interest, but it removes the pressure of a typical repayment schedule.

In theory, as your Bitcoin collateral increases in value, you can use the increase to pay down your outstanding debt obligation.

- Are there any hidden fees?

No. The known fees include:

- Interest Rate (1%–5% fixed APR for the life of the loan).

- Gas Fees for blockchain transactions, depending on the network.

- Refinancing Fees in cases where you change loan terms.

- Redemption Fee (0.5%) for converting MUSD back to BTC when you have no existing loan. Converting MUSD to BTC when you have an existing loan incurs no additional redemption fee.

If new fees are introduced in future updates, they will be transparently disclosed.

The road to banking on yourself starts with borrowing on Mezo.

👉 Start Today:

Join the Community:🕊 X (Twitter) | 📣 Telegram