How Mezo is Building BitcoinFi

BitcoinFi moves BTC from a passive store of value into a dynamic, yield-generating asset.

Bitcoin’s future lies in its integration into a comprehensive financial ecosystem, a vision we call BitcoinFi. BitcoinFi moves BTC from a passive store of value into a dynamic, yield-generating asset.

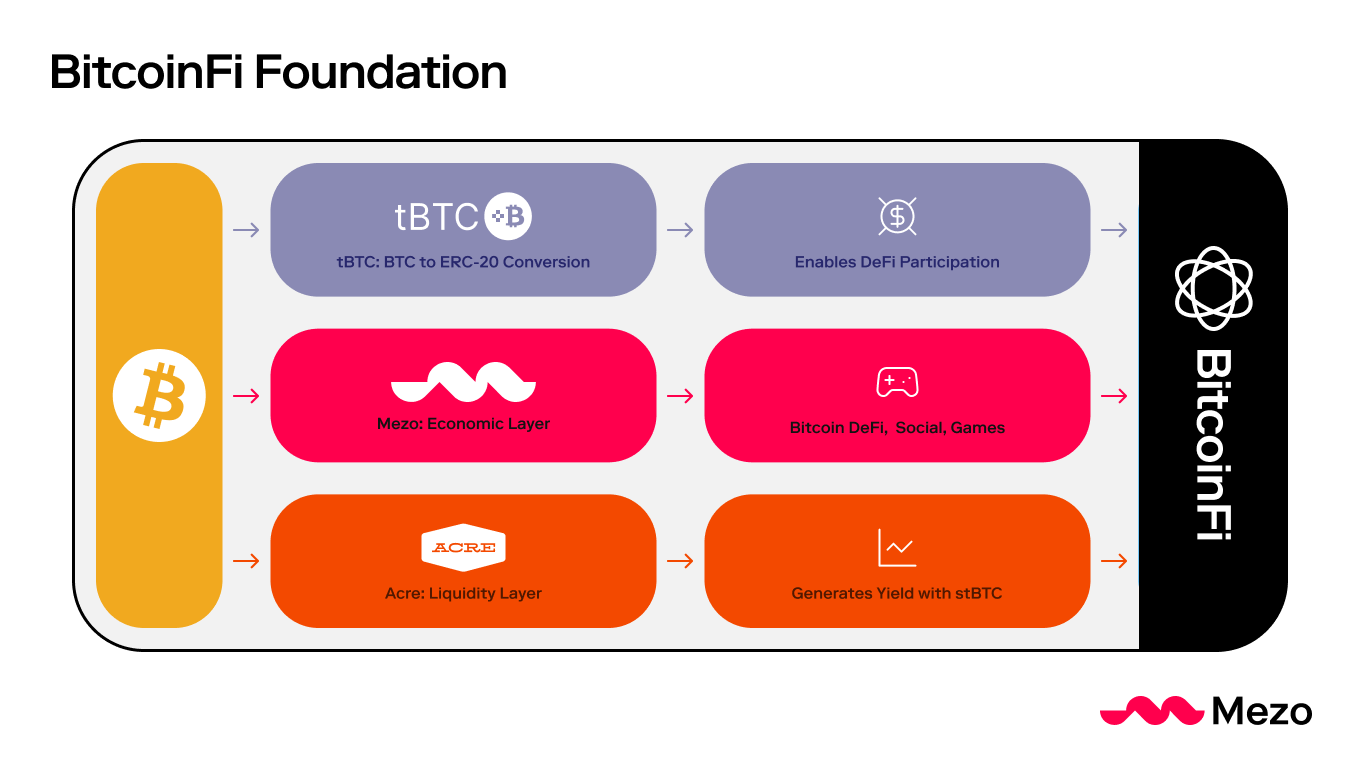

This transformation takes shape through three key pillars: tBTC, Mezo, and Acre's stBTC.

Bitcoin’s narrative has long emphasized its role as a long-term store of value, commonly articulated as "digital gold." This narrative worked initially but fails to realize Bitcoin’s full value and does nothing to propel Bitcoin into our daily lives.

As it stands, Bitcoin is not high-powered money. What’s needed is a platform that can make Bitcoin more functional. The real world is an open market bazaar and, as such, requires a payment system that is lighter, faster, and more efficient than Bitcoin's base layer can currently provide.

As Hal Finney astutely observed, "Bitcoin itself cannot scale to have every single financial transaction in the world..." He envisioned a future where Bitcoin-backed banks would issue their own digital currencies, a "secondary level of payment systems which is lighter weight and more efficient." These systems offer various financial products and services, from interest-bearing accounts to diverse investment opportunities. This would allow Bitcoin to serve as the "high-powered money" for these banks, facilitating efficient and scalable financial transactions while maintaining Bitcoin’s inherent value and security.

The next step in Bitcoin's journey is a dynamic economic ecosystem built around it – we call this BitcoinFi. To create economic activity around Bitcoin is to create BitcoinFi. In this world, Bitcoin is a store of value and a productive asset, powering a wide range of financial and social activities.

While a fully realized BitcoinFi ecosystem is still developing, we can already observe its emergence in over $10B of tokenized Bitcoin derivatives, Lightning Network payment rails, and Bitcoin savings accounts. While these early implementations provide glimpses of Bitcoin's broader financial utility, they remain fragmented and limited in scope.

This is where tBTC, Mezo, and Acre's stBTC come into play. tBTC serves as the bridge, securely tokenizing 3,200 Bitcoin across various blockchains. Mezo builds upon this foundation, providing the economic infrastructure that allows tokenized Bitcoin assets to interact seamlessly within a bustling DeFi ecosystem. Acre's stBTC introduces a staking mechanism that enables passive income generation.

These three pillars—tBTC's interoperability, Mezo's economic framework, and Acre's yield-generating capabilities—establish the foundation for BitcoinFi.

tBTC

tBTC is the linchpin that connects Bitcoin's immense value with the vast and dynamic world of DeFi. It solves one of crypto's most complex and actively pursued challenges: Bitcoin bridging. The idea of "unlocking your Bitcoin" by bridging it to alternative networks is not new, but it is long overdue for an update.

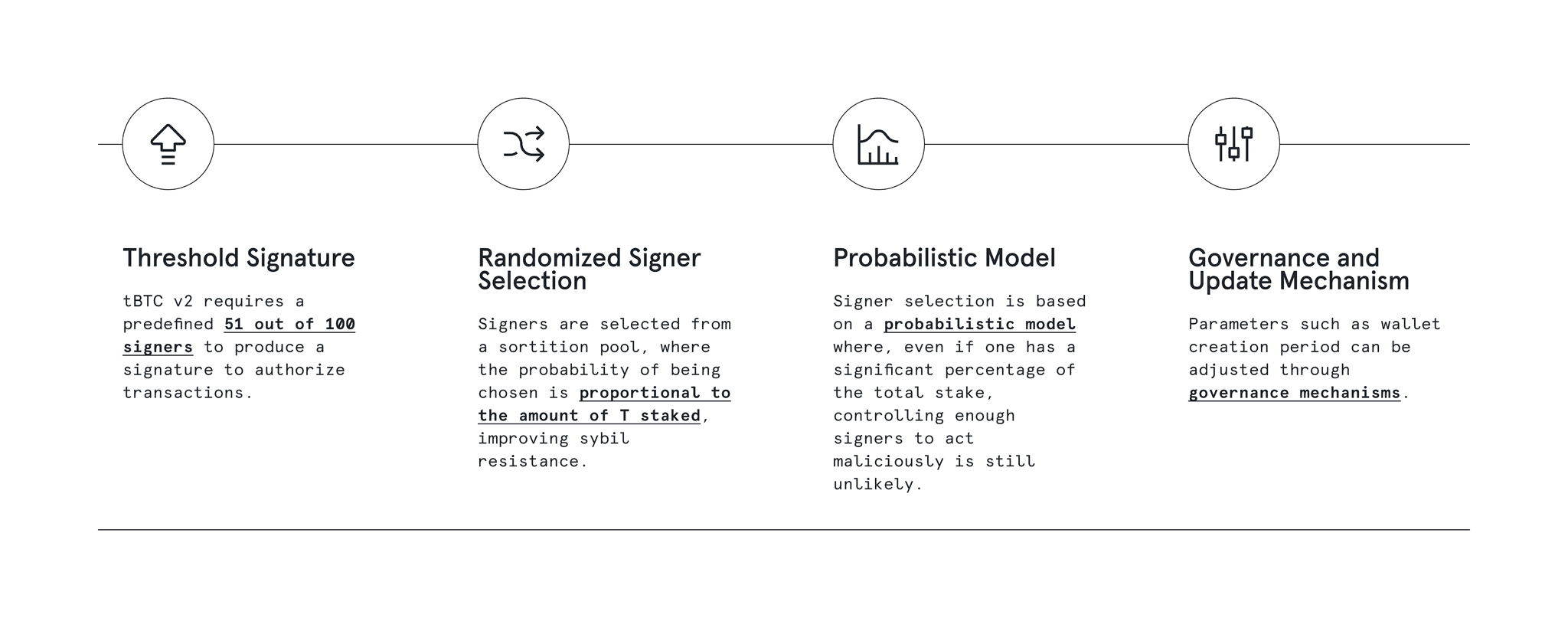

Current BTC bridging solutions often rehash existing methods, failing to address fundamental issues effectively. tBTC, however, introduces a novel approach that ensures security, flexibility, and usability, making it a cornerstone for integrating Bitcoin into the DeFi ecosystem and realizing the vision of BitcoinFi.tBTC v2 makes this a reality by leveraging threshold signature schemes and probabilistic guarantees to securely and efficiently move BTC from the Bitcoin blockchain to Ethereum, Optimism, Arbitrum, Base, and Solana. This approach minimizes trust requirements.

tBTC stands out particularly due to its decentralized nature and robust security. Unlike centralized solutions like wBTC, which rely on a single custodian and are susceptible to counterparty risk and regulatory concerns, tBTC employs a decentralized custody model.

This means that your Bitcoin is not held by a single entity but rather distributed among a network of stakers within the Threshold network. This approach significantly reduces the risk of theft or loss, as no single point of failure could be exploited.

This robust security framework is the foundation for tBTC’s utility in DeFi. tBTC gives Bitcoin wheels, allowing Bitcoin holders to participate in various DeFi applications without losing exposure to Bitcoin’s value.

With tBTC, Bitcoin holders can activate their idle BTC through yield pools on Uniswap, lending on Aave, and borrowing against it on Curve for crvUSD – all while maintaining custody of their principal BTC. tBTC's integration with Mezo further expands Bitcoin's utility by enabling BTC-denominated gas fees.

All these factors align with BitcoinFi’s fundamental goal: enabling the use of Bitcoin anywhere while maintaining the highest levels of security and control.

Mezo

The emergence of tBTC has laid the foundation for a thriving Bitcoin economy, and Mezo is the infrastructure that brings BitcoinFi to life. We understand that the narrative around Bitcoin needs to shift from mere “hodling” to more productive use. While the concept of "being your own bank" and "stacking sats" has resonated with early adopters, it fails to capture the utility of Bitcoin as a financial tool.

Mezo aims to transform Bitcoin from a passive store of value into an active and productive asset by introducing a comprehensive economic layer on Bitcoin.

Mezo seeks to bridge the gap between traditional finance and the Bitcoin ecosystem by offering a platform that enables users to utilize their BTC for various financial activities. At the core of Mezo's functionality is its integration with tBTC.

Users can leverage tBTC to bridge their BTC to the Mezo network, which can be used to access various DeFi applications. But Mezo doesn't stop at traditional DeFi applications. It aims to expand the scope of Bitcoin's utility by exploring novel use cases, such as running payroll on-chain and facilitating real-world financial transactions. These applications set the foundations for BitcoinFi and will take Bitcoin to scale, transforming it into an asset that is accessible and practical for everyday individuals and businesses.

Acre

Acre is the liquidity layer designed to scale BitcoinFi, enabling yield generation through staking. By depositing BTC into Acre, users receive stBTC, a Liquid Staking Token (LST) representing fractional ownership of the staked BTC. This process is a novel derivatization of Bitcoin, transforming it into a dynamic, yield-generating asset.

The emergence of yield-generating financial products has consistently marked turning points in the evolution of finance. Consider the advent of dividend-paying stocks in the early 20th century, which transformed equity ownership from speculation to a source of recurring income. This innovation democratized wealth creation, attracting a broader range of investors and fueling the growth of stock markets. Similarly, Acre aims to unlock new economic opportunities within the Bitcoin ecosystem by transforming BTC into a versatile, yield-generating asset through stBTC.

The stBTC token, designed as a non-rebasing asset, offers a unique value proposition. Unlike rebasing tokens, where the token supply fluctuates, stBTC's supply remains constant while its value increases relative to BTC. This appreciation is driven by the yield generated through staking activities, providing stBTC holders with a tangible and growing return on their Bitcoin investment.

To further amplify stBTC's utility within the BitcoinFi ecosystem, Acre is compatible with the ERC-4626 token standard. This enhances stBTC's efficiency and composability, seamlessly integrating with various DeFi applications. As a result, stBTC holders can explore many financial strategies, such as borrowing against their stBTC or providing liquidity to earn additional yield.

BitcoinFi

BitcoinFi is the culmination of tBTC, Mezo, and Acre's collaboration to expand Bitcoin’s utility. No longer confined to the role of a passive store of value, Bitcoin can be a dynamic financial instrument capable of generating yield and participating in a diverse range of financial activities within the vibrant DeFi ecosystem.

- Lending and Borrowing: Lend your BTC to earn interest or borrow against it to access liquidity for other investments. This includes borrowing Bitcoin-backed stablecoins, allowing you to spend fiat while saving your Bitcoin.

- Yield Farming: Participate in yield farming strategies to maximize your returns on BTC.

- Decentralized Trading: Trade on native DEXs.

- Derivatives: Access Bitcoin-based, on-chain derivative products.

- Culture Attestation: Define your meme-economy on Bitcoin.

- Passive Income Generation: By depositing BTC into Acre, users receive stBTC tokens, representing their share of the staked Bitcoin. This staked BTC is used to validate transactions on various Layer 2 networks, generating yield distributed back to stBTC holders.

- Robust Security: BitcoinFi enables the inheritance of Bitcoin's security. tBTC's decentralized custody model adds additional layers of security by minimizing risks associated with centralized solutions, providing a secure and trust-minimized environment.

Realizing the Future of BitcoinFi

BitcoinFi represents the future of Bitcoin, transforming it from a passive store of value into a dynamic, yield-generating asset. By leveraging the strengths of tBTC, Mezo, and Acre, users can participate in various financial activities and products while maintaining the security and value of their BTC holdings. This integrated approach enhances Bitcoin's financial utility. It brings us closer to fulfilling the vision of Bitcoin as "high-powered money" that serves as the reserve currency for a new, decentralized financial system.

Links

Deposit to Mezo with an invite code today. Join us:

👾 Discord: https://discord.mezo.org

🕊 X: https://twitter.com/MezoNetwork

🖥 Website: https://mezo.org

🏦 Deposit Portal: https://mezo.org/hodl

ℹ️ Docs: https://info.mezo.org