Bitcoin-Backed Loans: How to Keep Your BTC and Get Cash with Mezo

Borrowers will no longer have to choose between holding Bitcoin and using its value. This is the future of Bitcoin banking.

The number one question we get asked is: How do I save my Bitcoin for the future if I need to spend it today? Enter Bitcoin-backed loans.

These loans let you borrow spendable dollars using your BTC as collateral—no selling required. This means no taxable events, no lost upside potential, and, most importantly, no regrets when Bitcoin's price rises.

How Do I Save My Bitcoin for the Future if I Need to Spend It Today?

The math is simple but powerful: Let's say you need $50,000 USD (fiat) for a home renovation. You could sell some BTC to access $50,000 to fund it. But what happens when Bitcoin inevitably appreciates? You've just missed out on potential gains. Even worse, you'll owe capital gains taxes on your sale, meaning you might need to sell even more Bitcoin to cover your tax bill.

Instead, you could take out a Bitcoin-backed loan using that same Bitcoin as collateral. Here's how the numbers work out:

- Collateralize 1 BTC ($107,000) at a 50% loan-to-value ratio

- Receive $53,500 in stablecoins or fiat

- Need less? Collateralize 0.5 BTC ($53,500) to get your $25,000

- Pay interest rates typically ranging from 4-10% APR

- Keep full exposure to Bitcoin's upside

- No taxable event triggered

The key difference? When Bitcoin appreciates, your collateralized Bitcoin appreciates in value too. You've maintained your position while accessing the cash you needed. Even after accounting for interest payments, you're still dramatically ahead compared to selling.

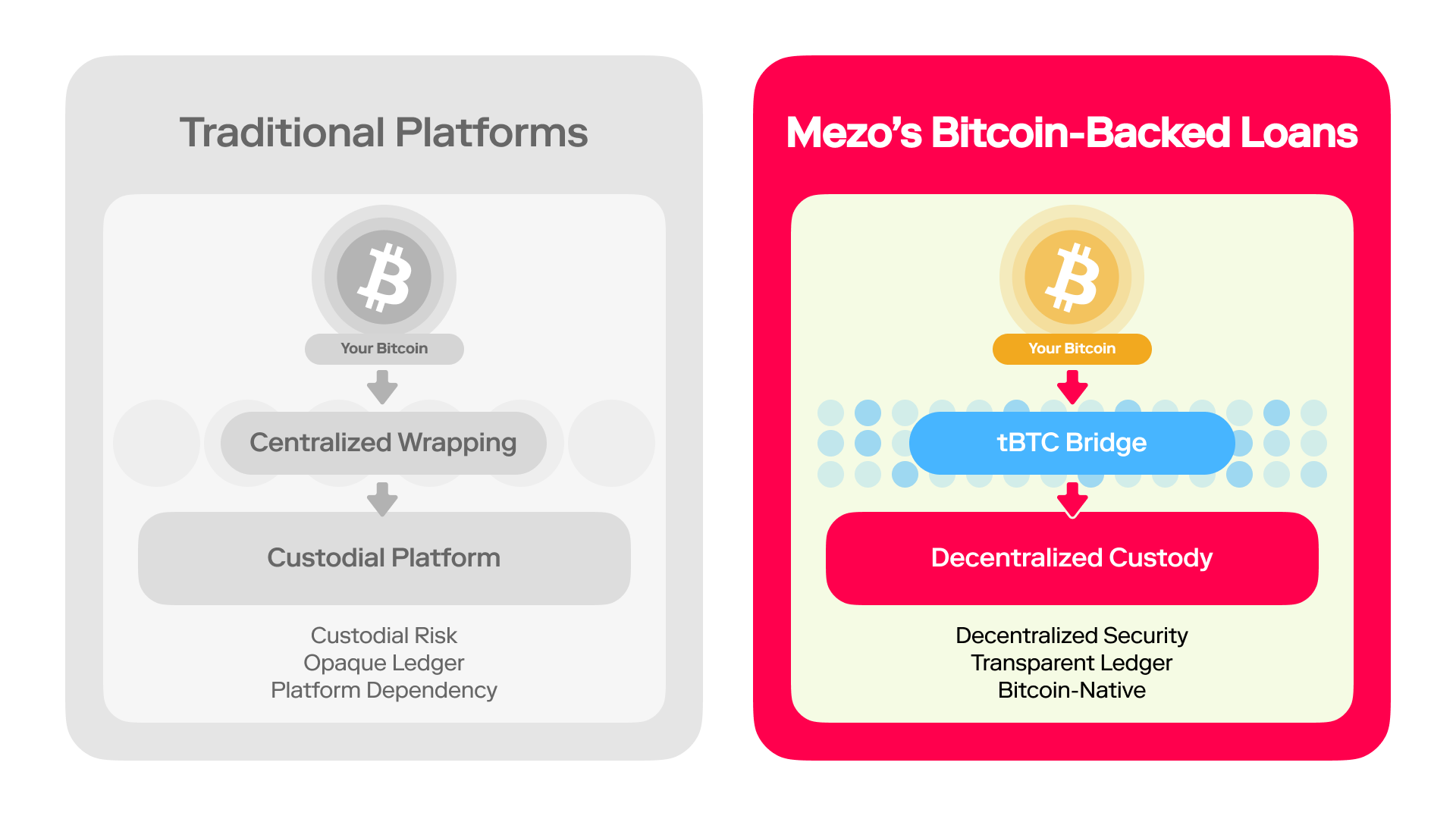

Mezo: A Better Approach

Traditional lending platforms—such as those operated by centralized custodians—often require you to fully hand over your Bitcoin. They can also impose variable interest rates that fluctuate at the platform’s discretion. Many of these services have endured liquidations and bankruptcies in recent years, leaving borrowers in precarious positions. It's a far cry from Bitcoin's founding principles of self-custody and user sovereignty.

Mezo is building a platform that focuses on personal control and low-cost lending. We combine an intuitive user interface with processes designed to keep your Bitcoin under your oversight as much as possible:

- Low, Fixed Interest Rates

- Keep Bitcoin staked as collateral and borrow spendable dollars (or stablecoins).

- By offering predictable terms and transparent guidelines, Mezo aims to be a simpler, safer alternative to legacy Bitcoin-backed loan providers.

Looking Ahead

Today mUSD lets you:

- Preserve Your Bitcoin

- Borrow at Low Fixed Rates

Borrowing against your Bitcoin without selling fundamentally changes how you interact with your holdings. Need to fund a business opportunity? Access emergency cash? Make a large purchase? You can do it all while maintaining your full Bitcoin position and exposure to future gains.

Coming Soon:

🏦 Instant Bank Integration – Move mUSD to your checking account seamlessly.

🛍️ Exclusive Discounts – Save on gift cards, travel, and partner deals when you spend mUSD.

💻 Frictionless Payments – Use mUSD online, in-store, or across apps.

Get a headstart today and learn how to borrow mUSD with your mats today on Mezo’s matsnet Alpha.

Official Links:

👾 Discord: https://discord.mezo.org

🕊 X: https://twitter.com/MezoNetwork

🏦 Deposit Portal: https://mezo.org/hodl-with/matsnet-alpha

ℹ️ Docs: https://info.mezo.org

📣 Telegram Announcements: https://t.me/mezonetwork